Dropshipping Taxes and Payments – Guide For Beginners

Do you need to pay dropshipping taxes? Sure do, dropshippers are no exceptions from this. Even though we enjoy the freedom from 9-5 jobs, or work from our comfort home, this doesn’t mean we are in a tax-free zone.

Paying taxes is required for all businesses, including those operated online. So, to stay in good legal standing, your dropshipping business must meet its tax obligations. In fact, the location and the legal structure of your business will affect the types of dropshipping taxes you have to pay.

But fear not! In this comprehensive guide, I’ll reveal the hidden gems, the pitfalls, and all the numbers that can make or break your success. So, let’s reveal “What kind of taxes do I need to pay for dropshipping?”, how to reduce them legally, and more.

Table of Contents

- What Is Dropshipping & How Does It Work?

- Do You Need to Pay Taxes for Dropshipping?

- How Do Taxes Work in Dropshipping?

- The No. 1 Tool for all dropshippers – now with AI

- Dropshipping and Taxes: What Kind of Taxes Do You Need To Pay For Dropshipping?

- Dropshipping Tax Guide: How Much Tax Do You Need to Pay?

- Dropshipping Taxes in Different Countries and Regions

- When Am I Required to Pay Sales Tax?

- How To Begin Collecting Sales Taxes?

- How to Set Up Your Dropshipping Taxes on Shopify

- What Are The Best Dropshipping Payment Processors?

- 5 Effective Strategies for Legally Lowering Your Income Tax Liability as a Dropshipper

- Conclusion

- Frequently Asked Questions

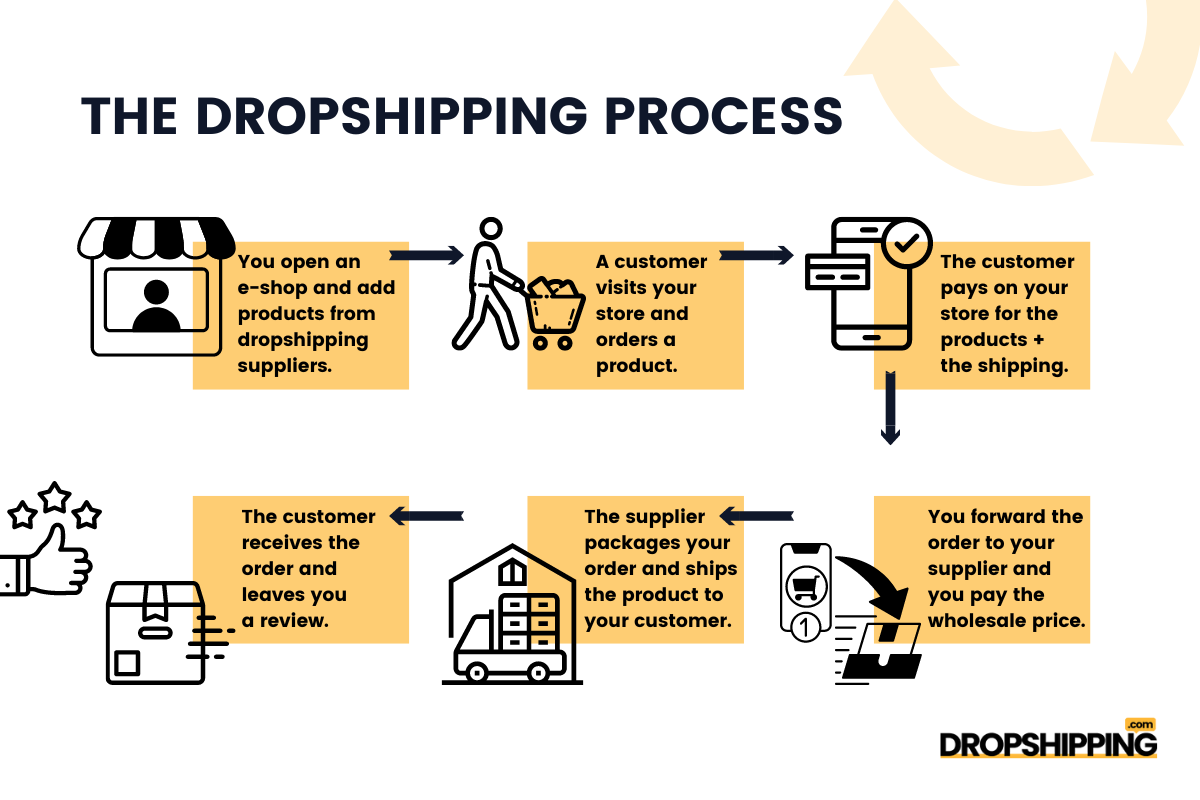

What Is Dropshipping & How Does It Work?

Dropshipping is a way of doing business where you can sell products online without needing to own any of those products.

But, how does it work?

Well, as a dropshipper, you don’t keep the products you sell in stock. Instead, you buy these products from a third-party supplier, and that supplier then sends them directly to the customer. This means that as the retailer (that’s you), you don’t have to physically handle the products, which reduces the initial costs and risks.

As a result, you make money by selling the products for more than what you paid to the supplier. This business model is favored for its low initial investment and flexibility. However, to succeed, you still need to put in a significant amount of time and effort. Now, let’s see how you can get started.

💡 Tip: Is Dropshipping Legal In 2024? Read This Before Starting.

Do You Need to Pay Taxes for Dropshipping?

Yes, you do need to pay taxes when you’re involved in dropshipping. It may sound a bit disappointing since dropshipping is a way to increase your income.

But remember, every business, including online ones like dropshipping, has to meet its tax obligations. Thus, as an entrepreneur running a dropshipping business, you are required to pay taxes.

Furthermore, paying taxes isn’t just a common requirement – it’s a legal obligation. In fact, paying taxes helps your dropshipping business stay on the right side of the law.

How Do Taxes Work in Dropshipping?

Before I get into the specific taxes you need to pay, let’s discuss how taxes function in the world of dropshipping.

Tax rules can vary from one country to another. Hence, some areas have higher tax rates, while others have lower ones, and a few don’t require tax payments at all.

Moreover, the way taxes are collected and paid can differ too. In some cases, you need to collect taxes from customers and then remit those to the government. In other cases, you simply pay the taxes directly.

For example, dropshippers often need to pay income tax based on their earnings to their local governments, although there are exceptions like nine U.S. states that don’t have an income tax.

On the other hand, taxes like sales tax involve a different process: you first collect it from customers and then pass it on to the government.

For guidance on handling dropshipping taxes, it’s advisable to consult with a professional accountant.

Dropshipping and Taxes: What Kind of Taxes Do You Need To Pay For Dropshipping?

In general, there are four types of taxes for dropshipping businesses. They are as follows:

1. Income Tax

Let’s start with the basics of income tax. Well, An income tax is a kind of tax that a government imposes on the income that businesses and individuals generate.

Moreover, as a dropshipping store owner, the amount of income tax you have to pay depends on your profit and the location of your business.

When running a dropshipping business, you need to pay income tax to your local government. This means that if your business is based in the United States, you will have to pay income tax to the US government. And even if your customers are based in, let’s say, France, you will have to pay income tax to the US government.

Luckily, this type of tax is easy to handle. It is not that complex compared to the sales tax.

2. Sales Tax

In essence, sales tax is a kind of consumption tax. Sales tax (in the U.S.), VAT (in the EU), and GST (in Canada) are forms of consumption tax.

Furthermore, governments impose this type of tax on the sale of products. And perhaps the most important thing you need to know about dropshipping and sales tax is that the end consumer (your customer) has to pay it since they “consume” the end product.

Vendors (in this case, dropshippers) serve as agents that collect the tax on the state’s behalf. As the sales tax is mainly the end consumer’s responsibility, vendors do not absorb the tax. They have to separately state the tax on the invoices or receipts they give to their buyers.

You are a dropshipper, aren’t you? So, you are probably confused and have no idea who has to collect the sales tax from the end customer. Are you, as a dropshipper, responsible for that? Or, is it the dropshipping supplier’s job to deal with it?

In most cases, you are not obliged to pay sales tax on products you buy from a dropshipping supplier for resale purposes. There is logic in this because you, as a dropshipper, are not the end consumer. You are actually a reseller that resells the products you buy from your supplier to the end consumer.

3. Dropshipping Source Taxes

Dropshipping source taxes are the taxes that you must pay to your supplier when you buy products from them to sell.

Thus, the specific taxes you need to pay will vary depending on where your supplier is located, but they may include sales tax, value-added tax (VAT), or goods and services tax (GST).

Similar to sales tax, our suppliers impose a percentage-based charge on the total purchase amount, which typically averages around 10%.

For example, if a product costs $15 initially and the source tax rate is 10%, the total payment would be $16.5. Consequently, you must factor the source tax into your profit margin computation to ensure that you reach the break-even point.

To make paying dropshipping source taxes easier, consider partnering with a supplier who has worked with dropshippers before. Some suppliers might include taxes in their product prices, making it simpler for you to calculate profits and pay taxes correctly.

Alternatively, you can use a third-party platform or service to handle tax calculations and payments for you. This option is especially helpful if you work with multiple suppliers in different locations and find it difficult to keep track of various tax laws.

4. Dropshipping Customs Duty Taxes

Customs duty is a tax that applies to goods shipped across international borders. It can be paid by either the dropshipper or the buyer upon delivery to the destination country.

Generally, the buyer is responsible for paying this tax.

To avoid any surprises, it’s important to inform your customers in advance about potential customs duty taxes.

👉 Discover How To Add Apple Pay To Shopify: Is It The Best For Conversions?

5. Self-Employment Taxes

As a dropshipper, you may be considered self-employed, which means you are subject to self-employment tax.

In fact, the self-employment tax is a tax on the net income earned by self-employed individuals, which includes both the employer and employee portions of Social Security and Medicare taxes.

For 2024, the self-employment tax rate is 15.3% on the first $160,000 of net income. This rate is made up of 12.4% for Social Security tax and 2.9% for Medicare tax.

However, remember that in some countries the income tax and the self-employment tax are calculated together. But, you should also be aware that they are not the same thing.

Dropshipping Tax Guide: How Much Tax Do You Need to Pay?

First and foremost, we want to point out that there’s no exact answer to this matter since all dropshipping businesses have different requirements.

| Types of Taxes | Rates (%) |

| Income Tax | 10% to 37% |

| Sales Tax | 0% to 11% |

| Source Tax | average rate of 10% |

| Custom Duty Tax | 0% to 37.5% |

Thus, the amount of tax you need to pay will depend on several factors, including your location, the location of your suppliers, and the type of products you sell. However, let’s give some range.

🔸 Income Tax

First, the income taxes. As of 2024, there are seven federal income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

So, I can say that you would pay an income tax of around 10- 37%. Thus, the ultimate amount of income tax you owe is subject to change based on your yearly earnings and the state where you live.

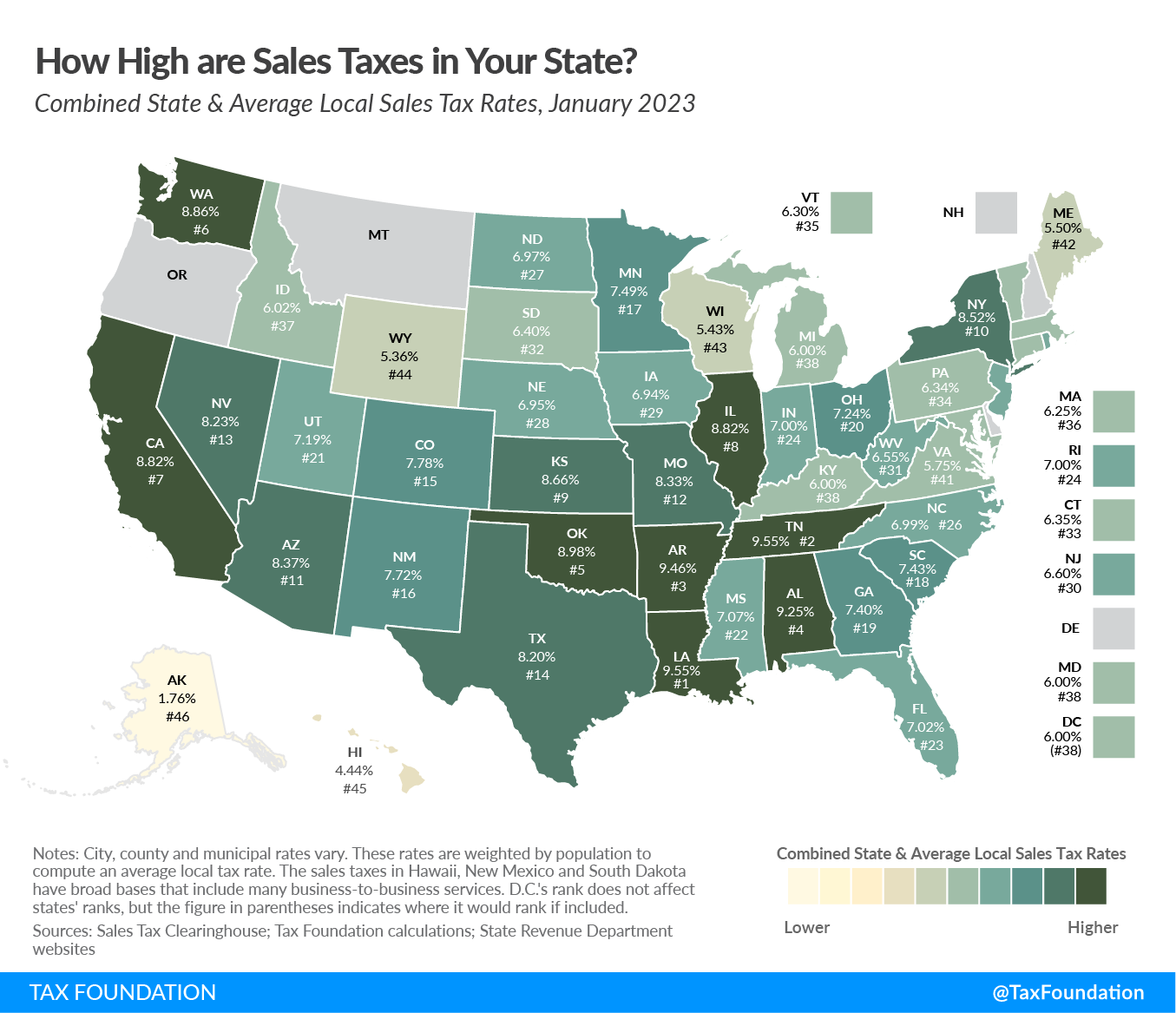

🔸 Sales Tax

Next, the sales taxes. In the United States, they vary based on the state where your customers live and can range from no tax to as high as 11%.

👉 Here you can check on the sales taxes in all US regions.

Also, keep in mind that if you’re selling from outside the US to customers in the US, you don’t have to pay sales tax since you don’t have a connection or “nexus” in the US.

However, in other countries, consult an accountant to make sure you understand any tax obligations you may have.

🔸 Source Tax

Furthermore, the source tax. This tax is added to the base price of each product and is charged by your supplier at an average rate of 10%.

🔸 Custom Duty Tax

Additionally, customs duty taxes can range from 0% to 37.5%. Hence, the amount of this tax you’ll owe depends on factors like the size, weight, and type of the product. Customs duty taxes are also based on the rules of the country where the product is being shipped.

Dropshipping Taxes in Different Countries and Regions

Whether your business operations are based in your home country or somewhere else, I have probably got you covered. Here, I will focus on the dropshipping taxes, particularly the sales tax, in the United States, Canada, and the EU.

🔹 Dropshipping Taxes In The US

You, as a new or an already established dropshipper in the U.S., must understand your dropshipping business’ path to meeting the legal requirements and complying with the tax obligations in the country.

👉 Do you need to pay sales tax to your dropshipping suppliers?

As mentioned above, you may not have to pay sales tax on what you buy from your dropshipping suppliers because you are a reseller.

And there is a sales tax exemption for products bought for resale in the United States. However, you must apply for an official exemption certificate to take advantage of the exemption.

In the United States, the rules for exemption certificates vary from state to state. That’s why it is advisable to consult a tax professional before applying for this certificate.

💡 Also Read: What is Tax Form 8821?

👉 Who Handles Sales Tax, You or the Supplier?

There’s no straightforward answer, but I’ll explain the common situations you’ll come across when buying from a dropshipping supplier and when selling to a customer.

👉 Do You Have to Pay Sales Tax to Your Dropshipping Suppliers?

Generally, when you order products from your suppliers, you usually don’t have to pay sales tax. That’s because there’s a sales tax exception for items meant for resale.

However, to benefit from this exception, your business must possess an official exemption certificate.

In the United States, there is a sales tax exemption for goods bought with the intention of resale. But you need to apply for an official exemption certificate to enjoy this benefit.

Also, the requirements for exemption certificates differ from one state to another in the US. That’s why it’s a good idea to seek advice from a tax professional before applying for such a certificate.

For example:

- Multistate Tax Commission: A single blanket sales tax exemption certificate accepted by 38 states.

- Streamlined Sales and Use Tax Agreement: If you’re registered for tax through SSUTA, a single Streamlined exemption certificate is valid in all Streamlined member states.

Furthermore, some states only accept certificates issued within their own state, while others recognize certificates that are valid in multiple states.

When you place an order with the supplier, you should provide them with your complete exemption certificate. Once they have it, the supplier won’t charge you sales tax.

👉 Do you need to charge your customers sales tax?

Remember that in this country, all vendors (whether dropshipping suppliers or dropshippers) are responsible for collecting and remitting sales tax if they have sales tax nexus in the state to which the order ships.

So, let’s explore two different situations:

➡ If you have a nexus in a state:

In such a case, you’re required to register for sales tax in that specific state. Subsequently, you must both collect and submit the applicable sales tax in all the states where you’ve completed the registration process. However, when it comes to dropshipping, things can get a bit confusing.

Some states impose sales tax on the entire retail price of the transaction, while others only apply tax to the wholesale price.

➡ If you don’t have a nexus in the state:

Typically, this implies that you’re exempt from charging and remitting sales tax. But, there’s an important exception to consider.

If the dropshipping supplier responsible for delivering the order is located in the same state as the customer, you could potentially be held responsible for sales tax.

Hence, some states consider an in-state supplier as a factor that triggers a nexus for that specific sale. California, New York, Texas, and Florida have particular provisions addressing this particular situation.

I know that the topic of dropshipping and taxes is quite complex and inundating, and, therefore, I will give an example.

I know that the topic of dropshipping taxes is quite complex and inundating, and, therefore, I will give an example.

Let’s suppose you run a dropshipping store for electronics from Massachusetts, meaning you have a “nexus” in Massachusetts. Thus, you have to collect sales tax from Massachusetts customers and remit the taxes collected back to the state.

However, if you sell, let’s say, a smartphone to a customer in California, you are not obliged to charge that customer sales tax since you do not have sales tax nexus in California.

And if your dropshipping supplier has nexus in the state, but you do not, they may be required to collect sales tax.

Since this is a complex issue, it is recommended to consult a tax professional and check the tax policy of each US state to ensure you are staying within the rules.

Check out our previous article about how to start a successful dropshipping business in the United States.

🔹 Dropshipping Taxes In The EU

Whether you are a dropshipper selling products to EU customers or an aspiring dropshipping entrepreneur looking to target the EU market, you have probably heard about VAT so far.

VAT stands for Value-Added Tax. As stated above, it is a kind of consumption tax similar to the sales tax in the United States.

👉 Do you need to pay VAT to your dropshipping suppliers?

In case your dropshipping business is VAT-registered in the European Union, and you are sourcing your products from an EU supplier, the reverse-charge mechanism will manage VAT on your purchase.

But in case your dropshipping business is based outside of the European Union and you are sourcing your products from an EU supplier, you will not have to pay VAT.

👉 Do you need to charge your customers VAT?

Well, it depends on whether your dropshipping business is based in the European Union or not.

On the one hand, you have to charge VAT on each sale you make in the EU if your business is based in the EU. On the other hand, you have to register for EU VAT and charge your customers VAT once you surpass the “distance selling thresholds” if your business is not based in the EU.

💡 Tip: Check out our guides on how to start a dropshipping business in Estonia, Italy, and Spain. Here, you can find the legal and tax guide on how to operate an online business in Estonia.

🔹 Dropshipping Taxes In Canada

In Canada, the sales tax is known as GST or Goods and Services Tax. Let’s clarify this point before I dive into the details. GST is also a type of sales tax or consumption tax.

👉 Do you need to pay GST to your dropshipping suppliers?

If you are a registered business in Canada with a valid GST/HST number, you will handle tax through Canada’s reverse-charge mechanism. Sure, you also need to consult a local tax accountant or other tax specialists to ensure your dropshipping business acts in compliance with the laws.

👉 Do you need to charge your customers GST?

Your business has to charge GST or HST in Canada unless it qualifies as an exception. That’s why it is crucial to understand the exceptions and the requirements for charging, collecting, and remitting this kind of tax in the country.

For more information, you can check out this guide. Also, read our previous article about dropshipping in Canada.

When Am I Required to Pay Sales Tax?

Paying sales tax becomes necessary when you have a “nexus.” States use this term to determine whether you should pay taxes within their borders.

A “nexus” is all about how closely connected you are to customers. For instance, if you live in Arizona but do most of your sales to customers in California, California is likely to want you to pay taxes.

Also, states decide if you have a nexus using two main criteria:

- Physical Presence: If you have a physical presence in another state, such as an office or warehouse, you’re considered to have a nexus in that state.

- Economic Presence: With the rise of eCommerce dropshipping, states also examine how much money you’ve earned from selling to their residents in a given year. Thus, each state sets its own rules for what counts as an economic presence. Generally, if you earn more than $100,000 in another state each year or process over 200 transactions, you’re likely to have a nexus.

It’s important to note that even if you didn’t make any sales in a particular state, you’re still required to file tax returns indicating that.

Additionally, if you can prove that you lack a nexus in a specific state, you won’t need to pay sales tax there.

However, if you’re selling on platforms like Amazon, eBay, or Shopify, they calculate and charge sales tax based on whether they have a nexus in a state.

How To Begin Collecting Sales Taxes?

To start collecting sales tax, you must obtain a sales tax permit from the state.

The process varies from state to state, but you can usually find the steps to apply for a permit by searching “[State name] sales tax certificate” on Google. For instance, here’s how I do it.

Also, most of the process can typically be handled online.

Furthermore, during the permit application process, the state will provide instructions on how to pay taxes and the frequency of filing. The good news is that many states offer user-friendly online platforms for managing sales tax, making it as simple as logging in and paying according to the state’s schedule.

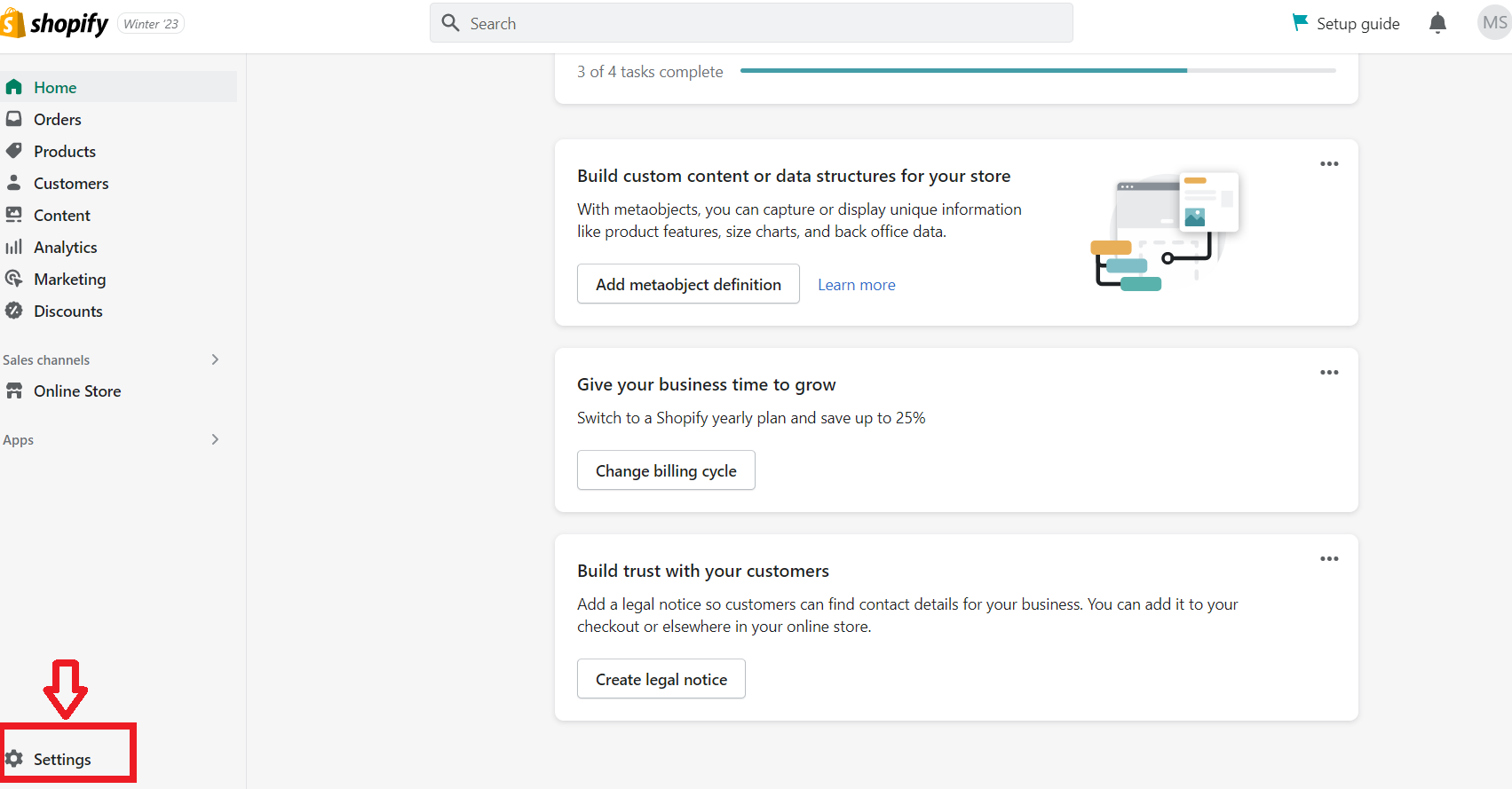

How to Set Up Your Dropshipping Taxes on Shopify

As you can see, as a dropshipping store owner, you may need to charge taxes on your sales, and then report and remit those taxes to the relevant tax authorities.

Tax laws and regulations are complex and change from time to time.

But Shopify is an e-commerce platform that automatically handles the most common sales tax calculations. Furthermore, the e-commerce platform uses many default sales tax rates and updates them on a regular basis.

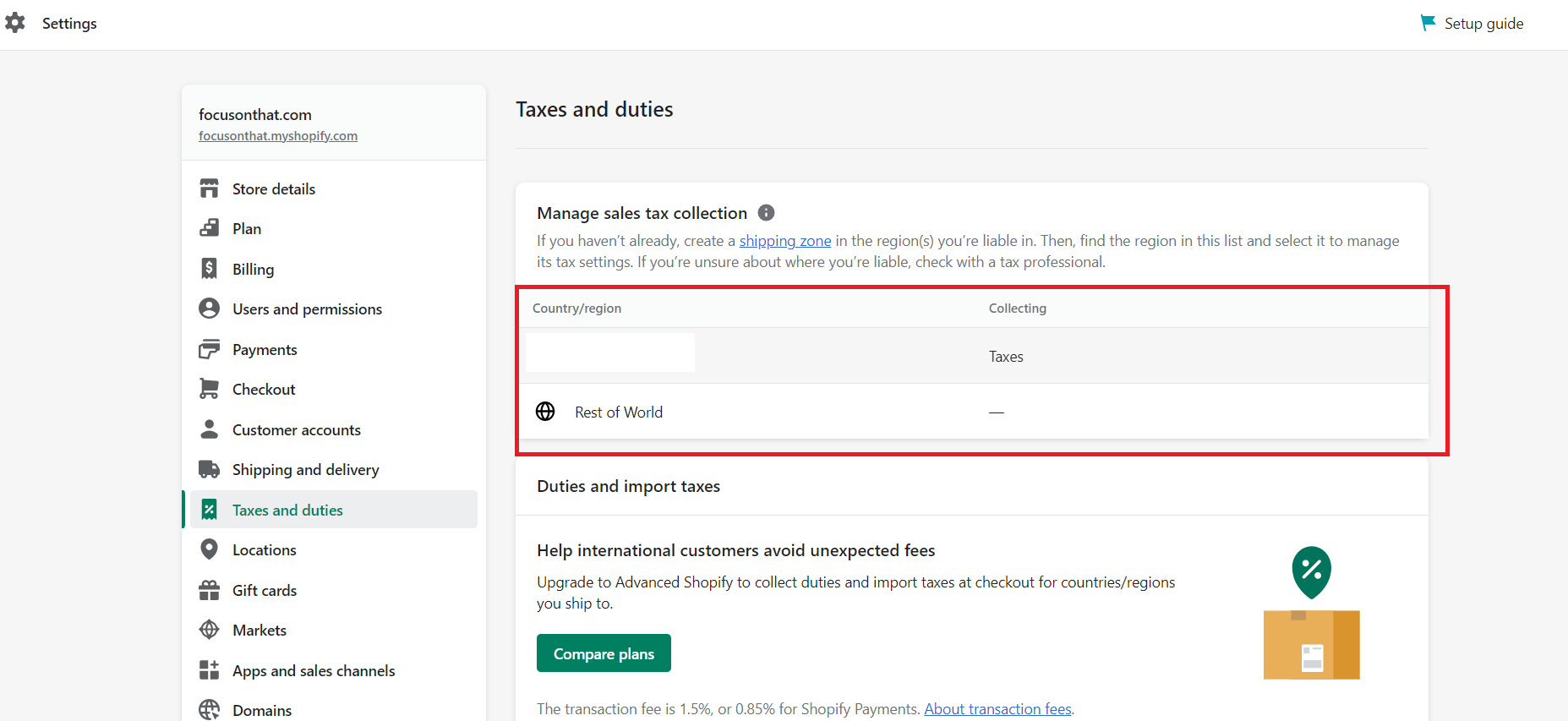

Now, let’s guide you through this step-by-step. To access Taxes and duties in Shopify admin, follow these steps:

Step 1 – Click on Settings.

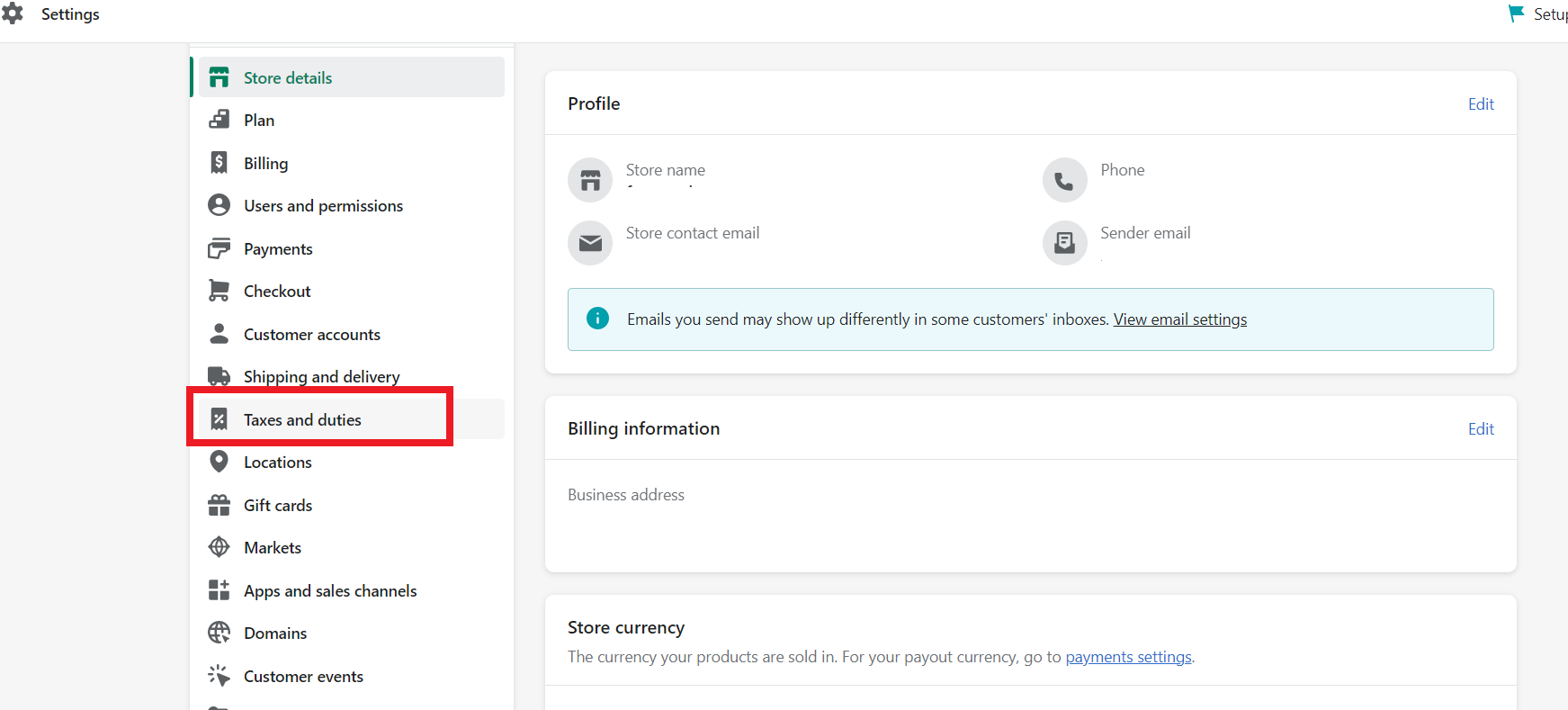

➡ Step 2 – Select Taxes and duties from the dropdown menu.

➡Step 3 – In the Countries/regions section, locate and click on your country or region.

The next thing you should do is go to the Sales tax section and select Collect sales tax. Then, enter your tax number in the Tax number field, and click to collect tax.

Optionally, if you want to add more regions and account numbers, click on Collect sales tax again.

What Are The Best Dropshipping Payment Processors?

First things first, dropshipping payment processors securely facilitate online money transactions between you and your customers.

For example, someone wants to buy an item from your online store. They add that item to their cart, fill in their address, and then provide their payment information. And this is where the dropshipping payment processors come into play.

In addition, here are some of the best and most commonly used dropshipping payment processors:

- Shopify Payments. This is one of the dropshipping payment processors completely integrated with the Shopify platform. Plus, it is simple to set up Shopify Payments.

- PayPal. Many entrepreneurs usually use this dropshipping payment processor for their online stores. Additionally, PayPal is available in about 200 countries worldwide. And it is easy to set up PayPal on Shopify.

- Stripe. Stripe is another popular payment processor available in more than 40 countries. Fortunately, selling online has never been easier with Shopify and Stripe.

- 2Checkout. 2Checkout supports diverse currencies and languages to streamline payment processing for online merchants and buyers in about 80 countries. And it is easy to install this payment processor on your Shopify store.

- Apple Pay. It targets Apple users and is a popular payment processor for mobile wallet transactions. You can learn here how to enable your customers to pay for their orders using Apple Pay.

💡 Tip: Read about the 7 Best Payment Gateways For Shopify In 2024.

👉 Learn How To Add Afterpay To Shopify: My 4-Step Guide + Examples.

💡Tip: Read about Dropshipping PayPal: How To Use It & Not Get Banned.

5 Effective Strategies for Legally Lowering Your Income Tax Liability as a Dropshipper

Who wants to decrease their revenues because of paying taxes? Hmm, well no one. But who wants to find themselves in the middle of legal issues? Let us guess, no one either.

But, what if I tell you that there’s a way to legally lower your dropshipping taxes while still remaining compliant with all tax laws and regulations?

Therefore, I will list some effective strategies you can use to legally lower your income tax liability.

🔸 Deduct Your Dropshipping Business Expenses

One of the most effective ways to lower your income tax liability is to deduct your business expenses. As a dropshipper, you may have expenses like website hosting fees, marketing expenses, eCommerce platform subscriptions, etc.

Therefore, keep track of these expenses and deduct them from your tax return to lower your taxable income.

💎 Some EXTRA suggestions:

- Keep meticulous records of your expenses related to your dropshipping business. Use accounting software or apps, like Xero, to streamline this process.

- Common deductible expenses include website hosting fees, marketing expenses, advertising costs, office supplies, and any other expenses directly related to your business operations. So, consider using more affordable options if necessary. For example, Facebook ads are very effective and cheap for marketing.

- Consult with a tax professional or research the specific tax laws in your jurisdiction to ensure you are claiming all eligible deductions.

👉 Read about What Is the Minimum Budget to Start Dropshipping with Shopify?

🔸 Maximize Your Retirement Contributions

Another strategy is to maximize your retirement contributions, such as contributing to a 401(k) or IRA.

Thus, as a self-employed individual, you may be able to contribute more to these accounts than employees of traditional companies. Also, consult with a financial advisor to determine the maximum amount you can contribute and take advantage of this strategy.

💎 Some EXTRA suggestions:

- Determine the maximum contribution limits for your chosen retirement accounts, and strive to contribute the maximum allowable amount each year.

- Seek advice from a financial advisor to understand how to best utilize retirement accounts to reduce your tax liability and secure your financial future.

🔸 Consider Forming an LLC

Consider forming an LLC, which can provide tax benefits for dropshippers.

In fact, this type of business structure can help separate your personal and business income and expenses, allowing you to take advantage of more deductions and lower your tax liability.

👉 Read about Do I Need an LLC For Dropshipping? The Sellers Guide.

💎 Some EXTRA suggestions:

- Research the legal requirements and benefits of forming an LLC in your jurisdiction. The process can vary from place to place.

- Keep separate financial accounts for your business and personal expenses to maintain the separation necessary for tax benefits.

- Consult with a tax professional or attorney experienced in business formation to ensure you make informed decisions regarding your business structure.

💡 Also, learn about LLC vs LLP: What’s The Big Difference?

🔸 Hire a Tax Professional

Lastly, hiring a tax professional can help you navigate your dropshipping taxes. They can help you identify deductions and credits that you may not be aware of and ensure compliance with all tax laws and regulations.

💎 Some EXTRA suggestions:

- Look for a certified and experienced tax professional or Certified Public Accountant (CPA) who specializes in small businesses or e-commerce.

- Provide your tax professional with comprehensive financial records, and communicate openly about your business operations to maximize tax savings.

- While hiring a tax professional may come with a cost, the potential tax savings and peace of mind from compliance are often worth the investment.

However, keep in mind that this might be a costlier strategy since you must pay this person to do the job.

👉 Read about Dropshipping Accounting: Tips For Managing Your Finances.

🔸 Consider Locating Your Dropshipping Business in Countries With No Income Tax Obligations

If you happen to be a resident of any of the following U.S. states, you can enjoy an exemption from paying income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Beyond the United States, various countries across the world also do not impose income tax obligations. Some of these nations include the Bahamas, Kuwait, Maldives, Qatar, and the United Arab Emirates.

Therefore, if your place of residence is in any of the mentioned states or countries, there’s no requirement for you to settle income taxes. Nevertheless, it remains essential to seek advice from a local accountant concerning tax responsibilities, irrespective of your location.

Conclusion

Paying dropshipping taxes is a necessary part of running a dropshipping business. To avoid unexpected costs and fines, you must acquaint yourself with the most common types of dropshipping taxes that you have to pay.

Again, do not forget to consult a tax professional because they will help you minimize your tax liabilities and advise you on important tax matters.

To let your customers buy something from your dropshipping store and pay easily and securely, you must select some of the best dropshipping payment processors. It is advisable to use multiple payment methods to meet and satisfy the needs of more customers.

Want to learn more?

The following links have been curated specifically for businesses looking for further information about dropshipping fulfillment, apps, profit margins & product pricing, etc.

- Dropshipping Fulfillment: Supply Chain and Fulfillment Process Explained;

- 18 Best Shopify Dropshipping Apps [Review & Comparison]

- Dropshipping Profit Margin and Pricing: A Step-By-Step Guide 2024;

- Expert Advice For Everyone Starting Their First Dropshipping Store;

- Dropshipping on Shopify vs. Amazon FBA [Expert Advice].

Frequently Asked Questions

1. What taxes do I need to pay as a dropshipper?

Dropshippers are required to pay taxes on their profits, just like any other business owner. This may include income tax, sales tax, and self-employment tax, depending on their location and other factors.

2. Do I need to collect sales tax on my dropshipped products?

You may be required to collect sales tax for your dropshipping products, depending on whether their state or your customers’ state has a sales tax.

3. How do I report my dropshipping income on my taxes?

Typically, dropshippers report their income as self-employment income on their tax return. This should be reported on Schedule C, along with any expenses related to their business.

3. What happens if I don’t pay my dropshipping taxes?

Failure to pay dropshipping taxes can result in penalties, interest charges, and even legal action taken by the government to collect the taxes owed.

So, I advise you to stay up to date with tax obligations to avoid any negative consequences.

![The Top 21 3PL Companies Compared [2024 List & Guide]](https://images.weserv.nl/?url=https://prod-dropshipping-s3.s3.fr-par.scw.cloud/2024/03/Frame-3922469.jpg&w=420&q=90&output=webp)