Do I Need an LLC For Dropshipping? The Sellers Guide [2024]

Curious if forming an LLC for dropshipping is necessary? This article dives into the legal and financial advantages that could safeguard your business and boost your credibility.

Whether you’re just starting or scaling up, discover how an LLC could protect your assets and potentially save you on taxes.

Ready to uncover the insights that might just reshape your dropshipping journey? Let’s explore!

Table of Contents

- Key Takeaways

- Do I need LLC To Start Dropshipping?

- What is an LLC? General Definition

- The No. 1 Tool for all dropshippers – now with AI

- Why Do You Need An LLC For Dropshipping?

- How To Create an LLC?

- How Much Does an LLC Cost?

- Advantages of Having an LLC

- What Type Of LLC Is Required For Dropshipping?

- Steps For Forming an LLC For Dropshipping

- How I Use Doola to Help Me Form an LLC for My Dropshipping Business?

- Dropshipping LLC – Frequently Asked Questions

- 1. Can I Start Dropshipping Without An LLC?

- 2. What is The Difference Between Sole Proprietorships Vs. LLC?

- 3. How To Run Your Shopify Business As A Sole Proprietor?

- 4. Do I Need A Business License To Sell On Shopify?

- 5. Can I have a partner in my dropshipping LLC?

- 6. Are there any downsides to forming an LLC for my dropshipping business?

- 7. Do You Need An EIN For Dropshipping On Shopify?

- 8. When To Consider Forming An LLC?

- Conclusion

Key Takeaways

| Key Takeaway | Valuable Insights |

|---|---|

| LLC Offers Personal Asset Protection | An LLC separates your personal assets from business liabilities, safeguarding your home, car, and savings from business debts or legal issues. |

| Tax Benefits of an LLC | LLCs provide pass-through taxation, which avoids double taxation and can lower your tax obligations, saving you money. |

| Builds Credibility and Trust | Having an LLC adds a layer of professionalism, helping you build trust with suppliers and customers, which can lead to increased sales. |

| Consider State Fees and Legal Requirements | LLC setup costs and annual fees vary by state. Research your state’s regulations and budget accordingly before starting. |

| LLC for Long-Term Growth | Forming an LLC provides a strong foundation for scaling your dropshipping business and opening the door to future investment opportunities. |

| Steps to Form an LLC |

|

Do I need LLC To Start Dropshipping?

So, do you need an LLC to start dropshipping? In my opinion, establishing a Limited Liability Company (LLC) for your dropshipping business is crucial.

Why? Because it provides essential personal liability protection. So, by forming an LLC, you separate your personal assets from any business debts or liabilities that may arise. Thus, this means that your home, car, and other personal assets will not be at risk if your dropshipping business faces legal issues or financial challenges.

Plus, you get various other benefits, like pass-through taxation. Also, registering as a legal entity shows professionalism and commitment, which can help gain the trust of customers and suppliers, potentially leading to increased sales. Now, let’s dive into this deeper!

👉 Read about Seller’s Permit vs. Business License: What Do You Need to Start Selling Online?

What is an LLC? General Definition

An LLC, or Limited Liability Company, is a business structure that combines the characteristics of a partnership and a corporation. So, one of the primary benefits of an LLC is that it provides limited liability to the owners, known as members. As I mentioned above, this means that the personal assets of the members are protected from the debts and liabilities of your dropshipping business.

Another advantage of an LLC is its “pass-through” taxation, whereby the profits and losses of your dropshipping business are reported on the members’ personal tax returns. Hence, this eliminates the issue of double taxation that may arise with other business structures, such as corporations.

What’s more, an LLC is recognized as a separate legal entity, distinct from its owners. It can be formed by individuals, corporations, and even foreign entities.

💡 Tip: Check out Is Dropshipping Legal In 2024? Read This Before Starting.

Why Do You Need An LLC For Dropshipping?

As a dropshipping business owner, I can tell you several reasons for having an LLC.

First and foremost, forming an LLC provides personal asset protection. This means that if your dropshipping business incurs debts or legal issues, your personal assets, such as your home or car, are shielded from being used to satisfy those obligations.

💡 Tip: Learn about LLC vs LLP: What’s The Big Difference?

Additionally, an LLC offers tax benefits, including the ability to report profits and losses on your personal tax returns, which can potentially save you money on taxes.

Also, building trust with your customers is essential in the dropshipping business model, and, for me, having the legal structure of an LLC really helped me gain a level of professionalism and trustworthiness.

Another advantage of having an LLC for your dropshipping business is the increased brand awareness it can bring. Customers often perceive businesses with a formal legal structure as more established and legitimate.

Plus, forming an LLC allows you to create a unique business identity, giving you the opportunity to differentiate yourself from other dropshipping businesses in the market.

💡 Tip: Read about Branded Dropshipping: Best Tactics For Building A Strong Brand?

How To Create an LLC?

Now, since I gave you an answer to “Do you need an LLC for Dropshipping”, let’s see how you can actually create an LLC.

So, there are two options you can consider:

- Using an LLC formation service

- Setting up the LLC yourself

If you choose to use an LLC formation service, they will guide you through the process step by step. However, if you decide to go the DIY route, there are a few key steps you need to follow. Hence, I will discuss these steps in detail, later in this article. However, here’s a quick list:

- Come up with a unique title for your LLC

- File the necessary paperwork, known as the Articles of Business or Articles of Organization

- Select a registered representative for your LLC

- Create an LLC operating agreement

How Much Does an LLC Cost?

And, as it is important to question “Do you need an LLC for dropshipping”, it is even more important to consider its cost.

Also, the cost of forming an LLC includes the initial filing fee and the ongoing annual or biennial fee.

Firstly, the initial filing fee is the cost of officially registering your LLC with the state and obtaining legal recognition as a business entity. Hence, this fee can vary depending on the state you are in, ranging from $40 to $500.

For example, based on LLC University data, the average filing fee for an LLC was around $132. But, this fee varies depending on your location.

Initial Filing Fee

For instance, for Massachusetts LLC you have to pay a $500 filing fee. On the other hand, Illinois LLC has a $150 filing fee👇

| State LLC | LLC Filing Fee | LLC Annual/Biennial Fee |

|---|---|---|

| Alabama LLC | $200 | $50 minimum (every year) |

| Alaska LLC | $250 | $100 (every 2 years) |

| Arizona LLC | $50 | $0 (no fee and no information report) |

| Arkansas LLC | $45 | $150 (every year) |

| California LLC | $70 | $800 (every year) + $20 (every 2 years) |

| Colorado LLC | $50 | $10 (every year) |

| Connecticut LLC | $120 | $80 (every year) |

| Delaware LLC | $90 | $300 (every year) |

| Florida LLC | $125 | $138.75 (every year) |

| Georgia LLC | $100 | $50 (every year) |

| Hawaii LLC | $50 | $15 (every year) |

| Idaho LLC | $100 | $0 (however, an information report must be filed every year) |

| Illinois LLC | $150 | $75 (every year) |

| Indiana LLC | $95 | $31 (every 2 years) |

| Iowa LLC | $50 | $30 (every 2 years) |

| Kansas LLC | $160 | $50 (every year) |

| Kentucky LLC | $40 (sorry, I said $90 in the video) | $15 (every year) |

| Louisiana LLC | $100 | $35 (every year) |

| Maine LLC | $175 | $85 (every year) |

| Maryland LLC | $100 | $300 (every year) |

| Massachusetts LLC | $500 | $500 (every year) |

| Michigan LLC | $50 | $25 (every year) |

| Minnesota LLC | $155 | $0 (however, an information report must be filed every year) |

| Mississippi LLC | $50 | $0 (however, an information report must be filed every year) |

| Missouri LLC | $50 | $0 (no fee and no information report) |

| Montana LLC | $35 | $20 (every year) |

| Nebraska LLC | $100 | $13 (every 2 years) |

| Nevada LLC | $425 | $350 (every year) |

| New Hampshire LLC | $100 | $100 (every year) |

| New Jersey LLC | $125 | $75 (every year) |

| New Mexico LLC | $50 | $0 (no fee and no information report) |

| New York LLC | $200 | $9 (every 2 years) |

| North Carolina LLC | $125 | $200 (every year) |

| North Dakota LLC | $135 | $50 (every year) |

| Ohio LLC | $99 | $0 (no fee and no information report) |

| Oklahoma LLC | $100 | $25 (every year) |

| Oregon LLC | $100 | $100 (every year) |

| Pennsylvania LLC | $125 | $7 (every year) |

| Rhode Island LLC | $150 | $50 (every year) |

| South Carolina LLC | $110 | $0 (no fee and no information report, unless LLC is taxed as an S-Corp ) |

| South Dakota LLC | $150 | $50 (every year) |

| Tennessee LLC | $300 | $300 (every year) |

| Texas LLC | $300 | $0 for most LLCs (however a No Tax Due Report and Public Information Report must be filed every year) |

| Utah LLC | $54 | $18 (every year) |

| Vermont LLC | $125 | $35 (every year) |

| Virginia LLC | $100 | $50 (every year) |

| Washington LLC | $200 | $60 (every year) |

| Washington DC LLC | $99 | $300 (every 2 years) |

| West Virginia LLC | $100 | $25 (every year) |

| Wisconsin LLC | $130 | $25 (every year) |

| Wyoming LLC | $100 | $60 minimum (every year) |

👉 Learn more: Starting your own company in Singapore.

Annual Or Biennial Fee

In addition to the initial filing fee, there is also the annual or biennial fee that needs to be paid to keep your LLC in compliance with state regulations. This fee is an ongoing expense and the amount can vary by state.

In addition to the previous example, Massachusetts LLC is $500 every year, while Illinois LLC is $75 every year.

So, it’s important to factor in these costs when budgeting for your dropshipping business to ensure you are compliant with the law and have the necessary legal protection.

👉 Read about Dropshipping Taxes and Payments – Must-Know Facts.

Advantages of Having an LLC

There are several benefits of forming a Limited Liability Company (LLC) for your dropshipping business.

👉 Also, check out the Pros And Cons Of Dropshipping: Does It Actually Work?

So, as I explain all the benefits of having an LLC, you will get to the point about “Do you need an LLC for Dropshipping”, and why exactly.

✅ Personal asset protection

Firstly, an LLC provides personal asset protection, meaning that your personal assets are separate from your business assets. This means that your business is shield from any business debts or liabilities.

Thus, this protects your personal savings, home, and other assets from being used to pay off any business debts.

✅ Tax Benefits

Secondly, an LLC offers tax benefits. So, by default, LLCs are treated as pass-through entities for tax purposes, meaning that the business profits and losses are passed through to the individual owners and reported on their personal income tax returns.

So, this allows for the avoidance of double taxation, as the income is only taxed once at the personal level rather than both at the corporate and personal levels.

✅ Building Level of Trust & Reliability In Your Dropshipping Business

Furthermore, forming an LLC adds a level of trustworthiness to your dropshipping business. In fact, having a legal entity like an LLC indicates that you are a serious and legitimate business owner.

Also, it provides credibility and instills confidence in potential customers, dropshipping suppliers, and partners. These may be hesitant to work with unincorporated businesses.

✅ Opens Possibilities For Growth

Lastly, an LLC opens up possibilities for business growth and expansion. It allows for the flexibility to bring in additional owners or investors. Thus, this can provide access to more capital, resources, and expertise. Thus, this can fuel the growth of your dropshipping business and help it reach new heights.

👉 Read about How Much Does It Cost To Start Dropshipping In 2024?

What Type Of LLC Is Required For Dropshipping?

When it comes to setting up an LLC for your dropshipping business, it is important to consider the different types of LLCs available. For sole owners, a single-member LLC may be suitable, providing personal asset protection and tax benefits. Hence, this is the one I have.👇

On the other hand, if you are in a partnership or have multiple owners, a multi-member LLC may be more appropriate.👇

Additionally, it is crucial to assess any industry-specific regulations and licensing requirements that may apply to your dropshipping business. Also, different industries have different rules and regulations, and it is essential to ensure compliance to avoid any legal issues or penalties.

👉 Read about Dropshipping vs. Retail Arbitrage: Pros, Cons, and Where To Start.

Steps For Forming an LLC For Dropshipping

Do you need an LLC for Dropshipping? Yes, of course! And, there are lots of benefits to it. So, next, let’s explore the process of forming an LLC for your dropshipping venture.👇

1. Choose Your LLC Name

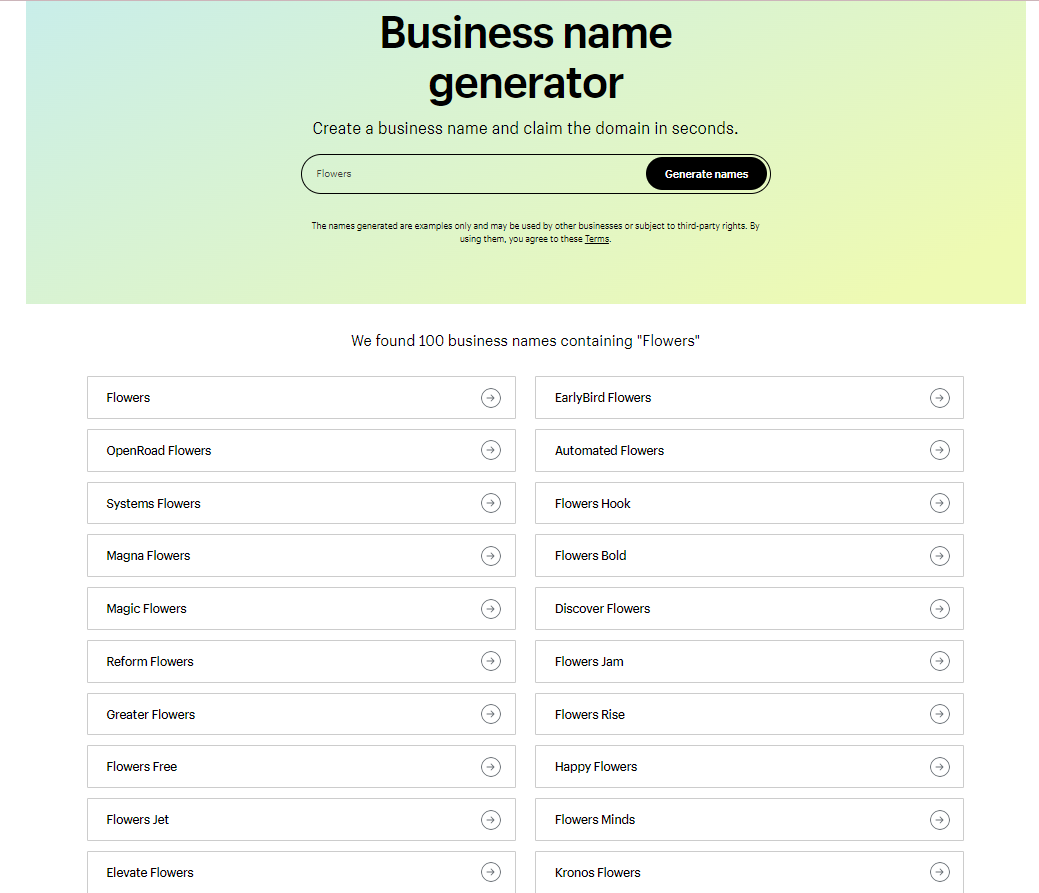

In order to choose an LLC name for your dropshipping business, it’s important to select a name that is unique and marketable. Also, having a unique name sets your dropshipping business apart from competitors and helps to establish your brand identity.

For instance, there are various name-generator tools available. Hence, I use the Shopify name generator tool for this purpose.

Thus, what I do is simply type in a keyword about my dropshipping business, and Shopify gives me ideas. In fact, that’s how I got my plant dropshipping business name in the first place. Check this out. I got 100 results in a second.

Plus, the Wix business name generator is also a great option.

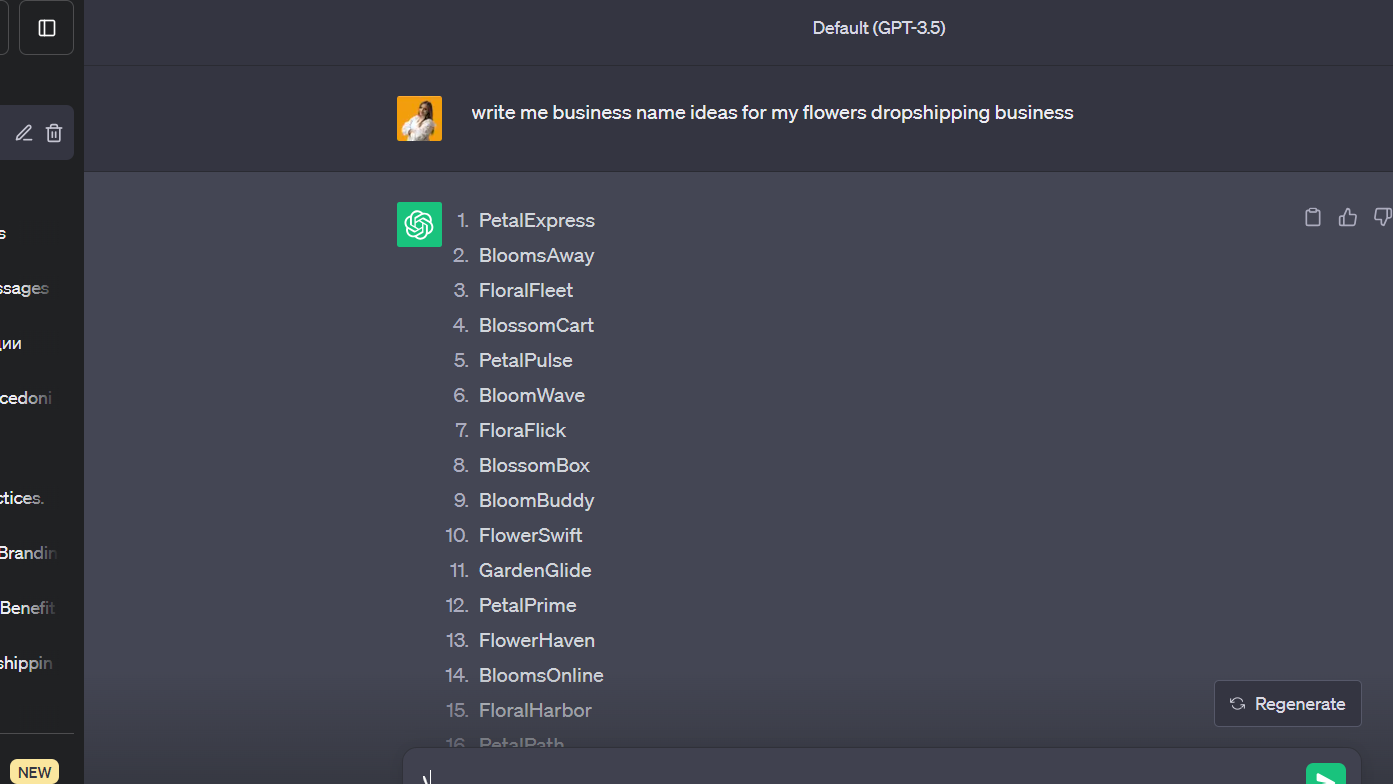

What’s more, you can also use AI tools, like ChatGPT to help you out with getting business name ideas. Thus, just write a prompt, and the tool will list you several options. 👇

💡 Tip: Read about GPT-4 for Ecommerce: What You Should Know in 2024.

Additionally, it is essential to ensure that the name you choose is not already registered by another business or subject to trademark infringements. Hence, this is to avoid legal issues that could arise from using a name that is already owned by someone else.

So, to check for name availability, there are several steps you can take.👇

➡ Firstly, conducting an online search can help you identify if any businesses already exist with the same or similar name. Hence, this can be done through search engines and social media platforms.

➡ Secondly, state business databases can provide information on registered business names within your state. Finally, searching the US Patent and Trademark Office database can help you determine if the name you have in mind is already trademarked.

2. Choose Your Registered Agent

The role of a registered agent is vital for your business’s success and compliance with state laws. They serve as the official point of contact between your dropshipping business and the state government.

Hence, your registered agent plays a key role in handling important legal documents and notifications on behalf of your dropshipping business. They receive and forward any official correspondence, such as tax forms, lawsuits, or other legal notices. This ensures that you stay informed about any legal obligations or actions that require your attention.

However, when selecting a registered agent, I advise you to consider some key factors, like:

➡ Availability is key – you want someone who will be accessible during regular business hours to receive important documents promptly.

➡ Reliability is also crucial as you need to trust that your registered agent will handle legal matters with professionalism and accuracy.

➡ Furthermore, you should ensure that your registered agent is well-versed in the legal requirements of your state and has experience working with small businesses. This knowledge and expertise will ensure that they can efficiently navigate any legal matters on your behalf.

3. File Your LLC Formation Documents

The next step in starting your dropshipping LLC is filing your LLC formation documents. This is an essential part of establishing your business as a legal entity. Each state has its own regulations and forms for LLC formation, so it’s important to familiarize yourself with the requirements specific to your state.

So, to file your LLC formation documents, you will need to gather important business information, such as:

- The name and address of your dropshipping business

- The names and addresses of the LLC owners

- The purpose of your dropshipping business

Also, these details will be included in the formation documents, which may vary depending on your state. For instance, some of the documents you may need are:

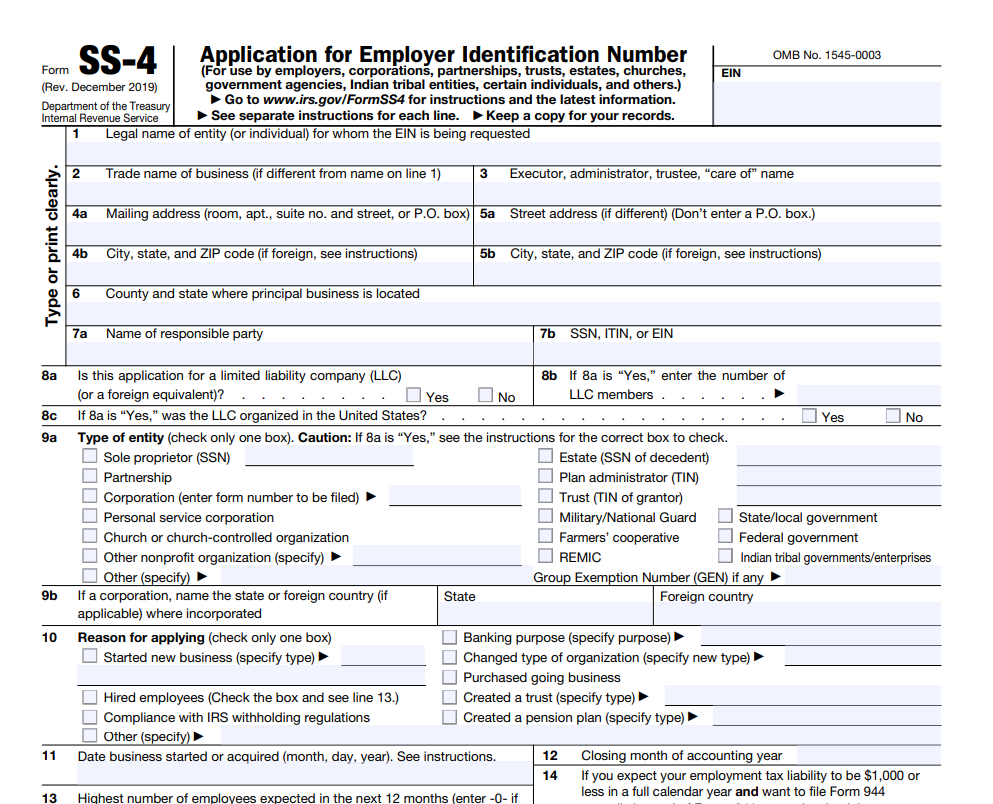

- Internal Revenue Service (IRS) Form SS-4

- Name reservation application

- Articles of organization

- Operating Agreement

- Initial and annual reports

- Tax registrations

- Business licenses

Once you have completed the necessary forms, you will need to sign them and file them with the secretary of state or the appropriate state agency. However, it’s important to carefully review the instructions and requirements for filing, as any mistakes or omissions could cause delays or complications.

Lastly, filing your LLC formation documents officially establishes your dropshipping business as a legal entity, providing you with limited liability protection and other benefits associated with forming an LLC.

4. Apply For an EIN

Now, let’s move on to the next important step in setting up your dropshipping LLC: applying for an EIN, or Employer Identification Number.

An EIN is a unique nine-digit number issued by the IRS for identification purposes, particularly for business-related matters such as taxes and banking transactions.

Applying for an EIN is a free and straightforward process that can be completed online through the IRS website. Hence, you need to send this SS-4 Form application to apply electronically, or via fax or mail.

📝 For those who do not know, the Internal Revenue Service (IRS) issues this number. And, you can apply for one online. Thus, you can do that here.

Also, the online application consists of a series of questions about your business, such as the legal name of your dropshipping LLC and its location.

What’s more, make sure to keep your EIN handy for any future business-related activities, as it will be used for various identification purposes throughout the lifespan of your dropshipping LLC.

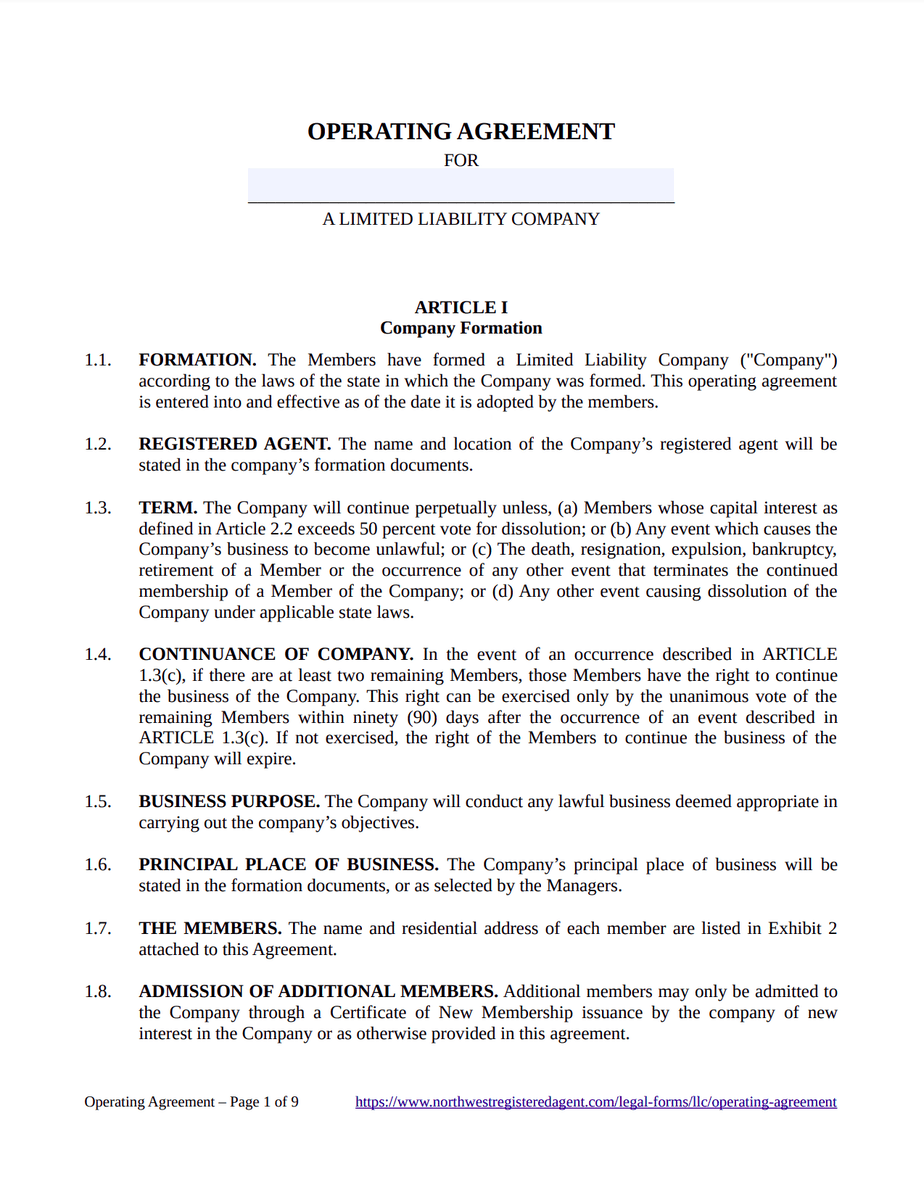

5. Create Your Operating Agreement

The operating agreement should include key elements such as the LLC’s name, purpose, and duration. It should also outline the members’ contributions, including capital and resources, as well as their ownership percentages and voting rights.

Additionally, the agreement should cover how profits and losses will be allocated among the members, and how major decisions will be made, such as admitting new members or selling the business.

However, in my opinion, you better have this agreement since it clarifies the internal structure and management of your dropshipping business. Plus, it reduces the potential for disputes or misunderstandings among members.

What’s more, it offers protection and limited liability for the LLC owners. It helps establish the LLC as a separate legal entity, which can protect the personal assets of the members in case of any legal issues or debts incurred by the business.

6. Create a Financial Infrastructure

This is the step I recommend you not to skip! Hence, creating a financial infrastructure for your dropshipping LLC is vital for managing your business finances effectively.

So, here are the essential steps to get started:

➡ Open a separate business bank account

This will help you keep your personal and business finances separate, making it easier to track your income and expenses accurately.

Having a dedicated business bank account also adds to the legitimacy and professionalism of your business.

➡ Obtain a business credit card

This will provide you with a convenient method of making business-related purchases, while also helping you build business credit.

So, having a separate credit card for your business will simplify tracking and categorizing expenses, making it easier to identify tax-deductible items.

➡ Track your income and expenses

Accurately tracking your income and expenses is crucial for understanding the financial health of your business.

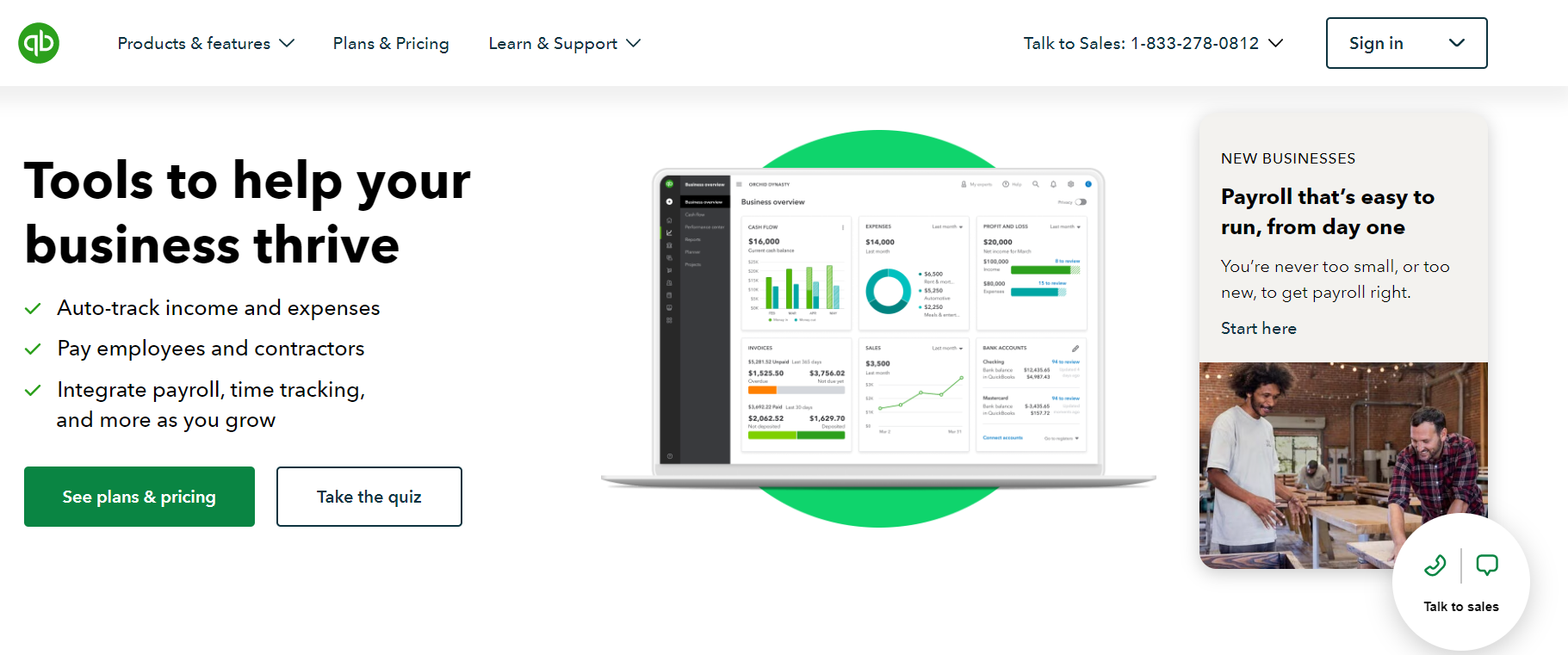

So, I recommend you use accounting software or tools to record every transaction and categorize it correctly.

For example, QuickBooks integrates with a vast array of tools, making it easier than ever to manage your online store.👇

Thus, by integrating Shopify with QuickBooks, you can ensure that your orders, inventory, customers, and shipping information are updated and accurate automatically.

This will help you generate accurate financial reports, analyze your business’s profitability, and identify areas for improvement.

➡ Maintain good financial records

This one is essential for tax purposes. This includes keeping invoices, receipts, and bank statements organized and easily accessible.

Thus, good record-keeping ensures that you claim all eligible expenses, accurately report your income, and stay compliant with tax regulations.

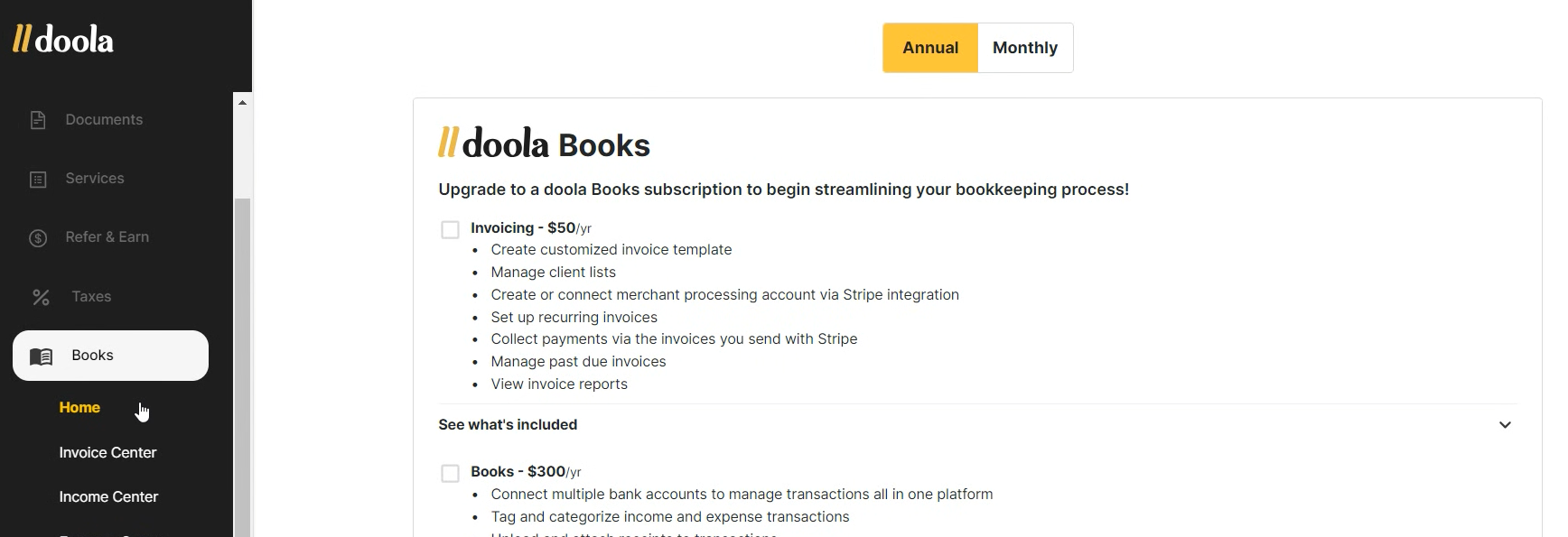

For example, Doola offers great bookkeeping services. Thus, you can create customized invoices, manage client lists, create connections with merchants’ accounts, etc.

By creating a strong financial infrastructure, you’ll be better equipped to manage your dropshipping LLC’s finances efficiently and make informed business decisions.

👉 Also, learn about Dropshipping Accounting: Tips For Managing Your Finances.

7. Apply for Licenses and Permits

Now that you have set up your dropshipping LLC, it’s important to ensure that you are in compliance with all the necessary licenses and permits.

However, the process of applying for these licenses and permits can vary depending on your state and the type of business you have.

Different industries may have specific licenses and permits that are required by government agencies. For example, if you are selling food or alcohol through your dropshipping business, you may need to apply for specific licenses in order to legally operate.

When it comes to applying for a seller’s permit, the majority of US states let you file your application for the document completely online. For example, if you want to do business in California, you can register online for a permit.

So, it is important to visit the website of your state’s Department of Revenue to see if you can apply online.

Also, as a dropshipper, you are actually reselling dropshipping products. So, consider that you might also need a reseller permit.

Additionally, obtaining a resale license is essential in order to evade sales tax on your purchases. States grant these licenses to prevent the double taxation of products. So, visit the website of your state’s Department of Revenue to determine whether you can apply online or not.

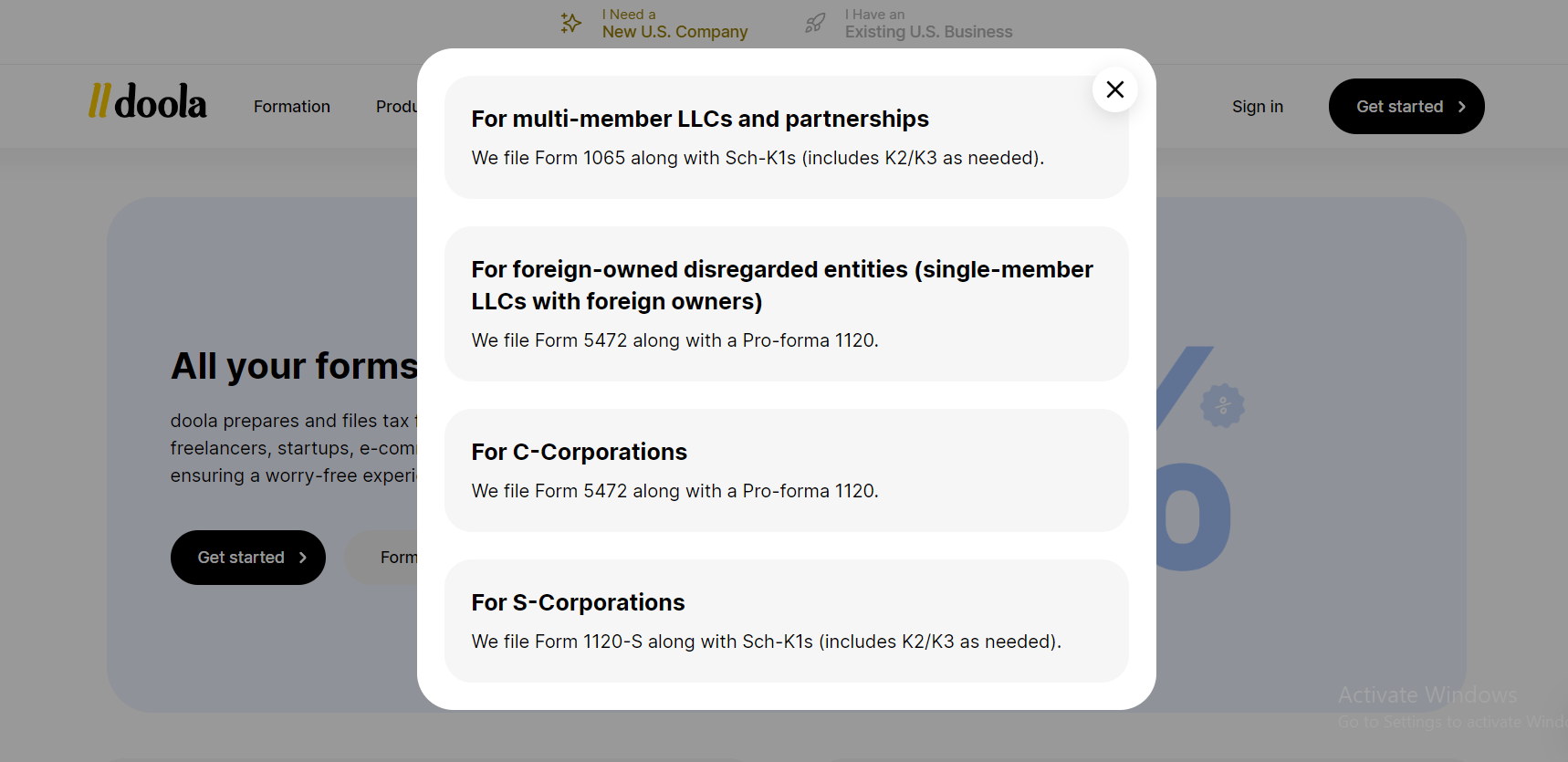

How I Use Doola to Help Me Form an LLC for My Dropshipping Business?

If you’re planning to start a dropshipping business and wondering how to structure it for success, forming an LLC can be a smart move.

Here’s how Doola helps you set up an LLC that fits your own personal needs while keeping everything streamlined and simple. Based on my experience, here’s a step-by-step guide, including some tips to help you along the way.

Step 1 – Select the Right State for Your LLC

For small business owners, particularly those running a dropshipping business, forming a Wyoming LLC is one of the best options.

This state offers potential tax benefits, including no state income tax and quicker processing times. Plus, you won’t have to worry about franchise taxes here, which can save you money in the long run.

Advice: Take into account the ongoing LLC fees and potential legal fees involved. While Wyoming has relatively low fees, forming an LLC involves costs, like the initial filing fee and the requirement to hire a registered agent to maintain legal compliance.

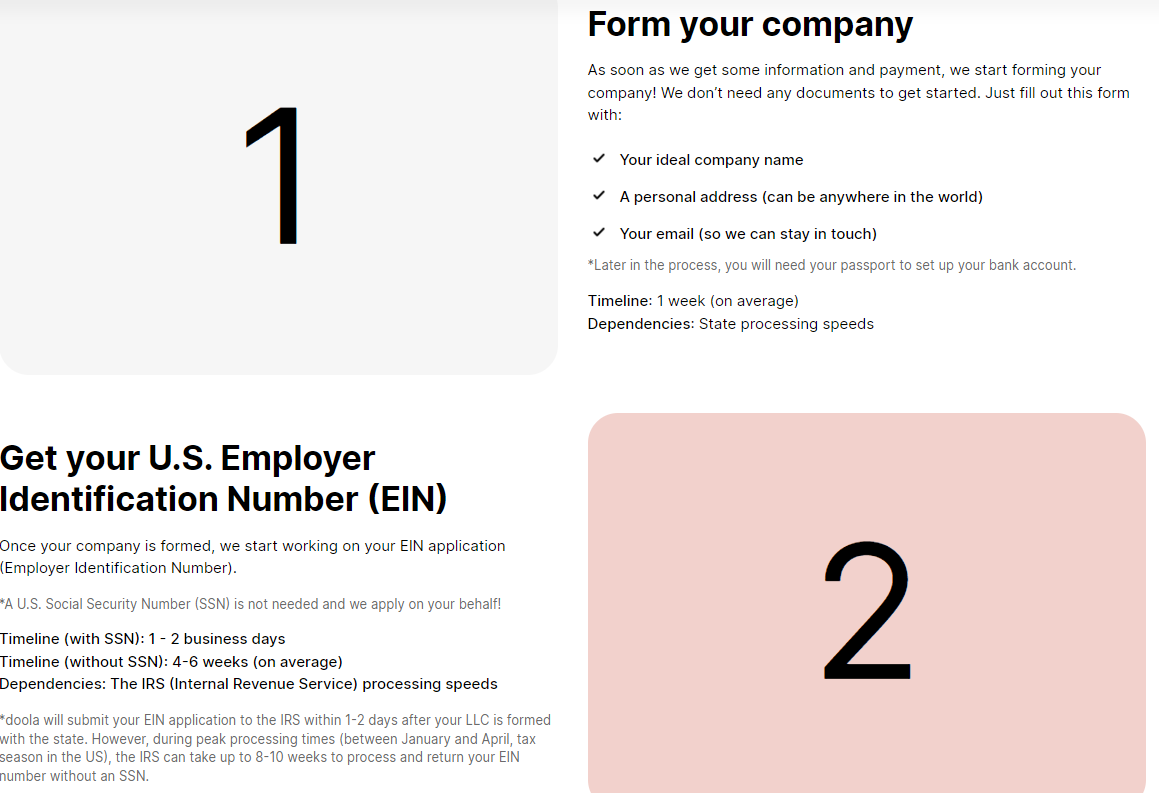

Step 2 – Form Your LLC with Doola

Doola makes the registration process easy. You’ll provide your company name, address, and some other basic details, and they’ll file the paperwork for you.

Hence, you don’t need a Social Security Number, a business location in the US, or to be physically present, which is a huge benefit for non-US residents.

Doola also helps you with creating an operating agreement for your LLC. This document is crucial because it outlines the management responsibilities and personal responsibilities of each owner.

Having this agreement protects your business assets and ensures you’re not personally liable for business debts.

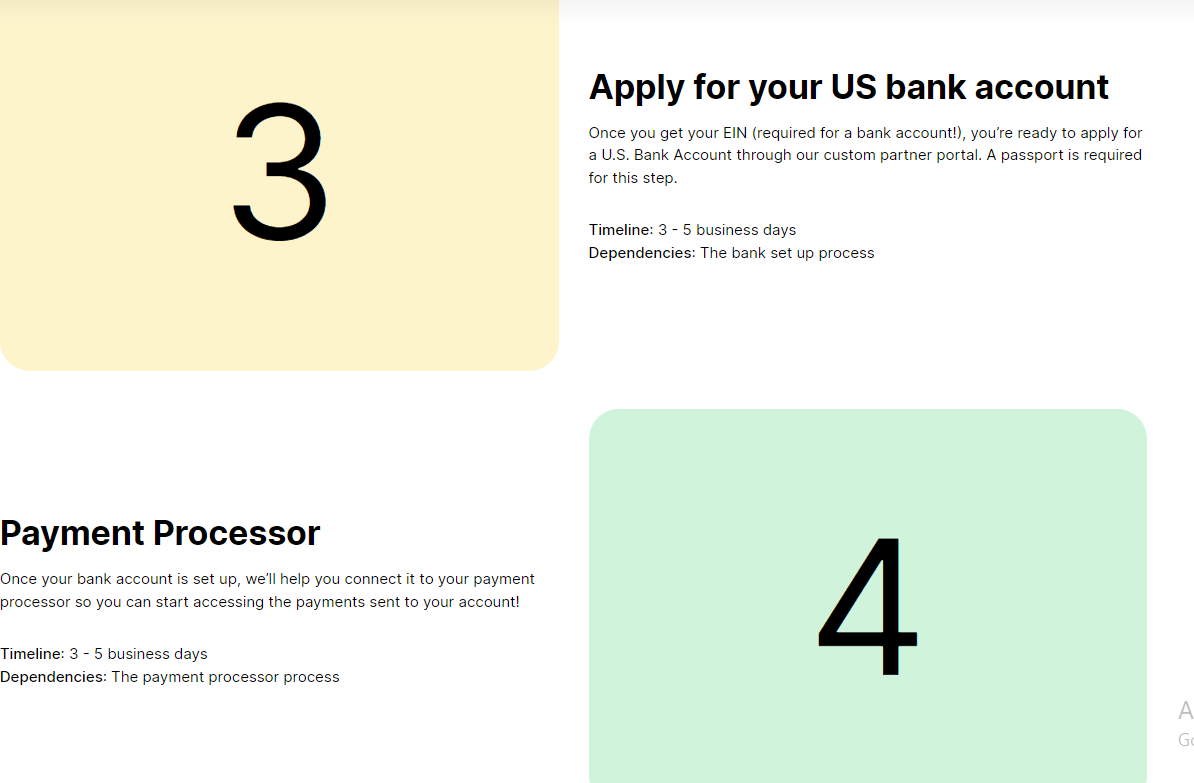

Step 3 – Obtain an EIN and Open a Business Bank Account

After your LLC is registered, Doola helps you get your EIN, a tax ID required for filing taxes and opening a business account. From my experience, Doola streamlines this process, and you can expedite the EIN to avoid long waiting times.

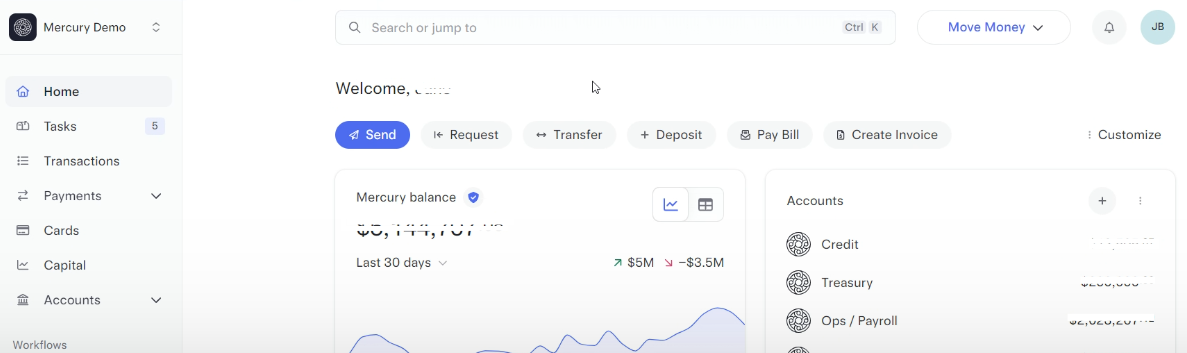

Next, Doola partners with Mercury Bank to help you open a business bank account. Having a dedicated account for your business finances is essential for managing your monthly profit margin and keeping your financial management organized.

This bank account gives you access to business credit cards, which can help you build business credit and separate your personal and business spending.

Step 4 – Manage Sales Tax and Tax Filing

One key consideration when running a dropshipping business is sales tax compliance. Doola offers guidance on handling sales tax based on where you sell your products.

Depending on whether you meet physical nexus or economic nexus thresholds, you may need to register for sales tax in certain states. Doola’s registered agent service ensures you stay compliant by helping you file all necessary paperwork.

Additionally, Doola helps you handle tax filing for your LLC. Keep in mind that forming an LLC can offer limited liability protection, meaning you won’t be personally liable for the company’s debts.

There are also tax advantages to consider, like avoiding double taxation. With an LLC, profits flow directly to your personal income, meaning you only pay taxes in your home country unless your business meets specific US tax obligations.

Tip: If your business recently started generating a significant monthly profit margin, be sure to keep up with Doola’s tools for tracking your LLC’s business income and filing the necessary annual reports. This ensures that your LLC remains compliant and that you avoid penalties.

Step 5 – Further Investment and Growth

As your business grows, you may find it beneficial to convert your LLC into an S Corporation or explore other business structures depending on your tax needs.

Moreover, Doola offers ongoing support and advice, which is invaluable when you need to assess the right business structure for scaling up.

They also help you keep track of filing annual reports, which can be critical for avoiding lapses in your business’s standing.

Dropshipping LLC – Frequently Asked Questions

1. Can I Start Dropshipping Without An LLC?

Starting a dropshipping business without forming a Limited Liability Company (LLC) is technically possible, but it comes with important implications. Without the protection of an LLC, your personal assets are at risk in the event of legal or financial issues.

Therefore, it is essential to consider the potential risks and benefits of forming an LLC for your dropshipping business.

2. What is The Difference Between Sole Proprietorships Vs. LLC?

Sole proprietorships offer simplicity in tax filing, as the business profits and losses are reported on your personal tax return. However, this convenience comes at a cost. Hence, sole proprietors are personally liable for business debts. This means that in the event of legal or financial issues, your personal assets are at risk.

On the other hand, forming an LLC provides personal liability protection. By separating your personal assets from your business, you shield yourself from any debts or legal disputes your dropshipping business may encounter. While registration and ongoing fees are required for an LLC, this investment can provide peace of mind and safeguard your personal assets.

In terms of income tax treatment, both sole proprietorships and LLCs can benefit from pass-through taxation. However, when it comes to startup costs, sole proprietorships have the advantage of being free to set up, while LLCs require registration fees.

3. How To Run Your Shopify Business As A Sole Proprietor?

Running a Shopify business as a sole proprietor can be a rewarding venture. To get started, the first step is to choose a catchy and unique business name. It’s important to check if the name is available and then register it as your own or file for a Doing Business As (DBA) if you want to use a different name than your own.

Next, it is crucial to determine if your state or local government requires a business license. So, research your jurisdiction’s guidelines and obtain the necessary license to operate legally.

Also, as a sole proprietor, you are responsible for reporting your business income and expenses on your personal tax return. Hence, this means you will be subject to self-employment tax, which includes both the employer and employee portions of Social Security and Medicare taxes.

4. Do I Need A Business License To Sell On Shopify?

So, do you need an LLC for dropshipping on Shopify? No, there is no federal requirement for a business license to sell on Shopify. However, it is important to note that some states, counties, or cities may have their own regulations in place.

Hence, if you own a small or medium-sized business, it is not mandatory to register your business or obtain an Employer Identification Number (EIN).

You have the option to operate your Shopify store as a sole proprietor and utilize your SSN (social security number) or SIN (social insurance number) for taxation purposes.

5. Can I have a partner in my dropshipping LLC?

Can I have a partner in my dropshipping LLC? Absolutely! If you want to have a partner in your dropshipping business, forming a multi-member LLC is the way to go.

A multi-member LLC allows you to share the financial responsibility and decision-making process with your partner.

6. Are there any downsides to forming an LLC for my dropshipping business?

While forming an LLC for your dropshipping business can provide personal liability protection, there are some potential downsides to consider.

Firstly, there is additional paperwork involved in setting up an LLC, including filing fees and business formation documents. Hence, this can be time-consuming and may require the assistance of legal professionals.

Furthermore, once the LLC is set up, ongoing compliance requirements must be met, such as filing annual reports and maintaining updated records. Thus, these ongoing obligations can be burdensome and may distract you from running your business.

Additionally, dealing with government bureaucracy can be frustrating and time-consuming. Finally, forming an LLC typically comes with higher costs compared to sole proprietorships or other business entities.

7. Do You Need An EIN For Dropshipping On Shopify?

Dropshipping on Shopify does not necessarily require an Employer Identification Number (EIN). However, there are certain situations where obtaining an EIN is necessary.

Thus, if you are dropshipping as a sole proprietorship and using your personal Social Security number for tax purposes, you may not need an EIN. This is because you are operating your business under your personal identity.

However, if you are operating as a limited liability company (LLC) or another type of business entity, you will need an EIN. This is because these types of business structures require a separate identification number for tax purposes.

8. When To Consider Forming An LLC?

When starting a dropshipping business, it is essential to consider the formation of a Limited Liability Company (LLC) for a variety of reasons.

So, considering the formation of an LLC for your dropshipping business can provide numerous benefits, including personal asset protection, tax advantages, and simplified business operations. Also, it is a decision that can positively impact your dropshipping business’s success and future prospects.

Conclusion

Forming an LLC for your dropshipping business offers several key benefits. In this article, I explained in-depth the benefits of forming an LLC.

So, in short, LLC provides personal liability protection, safeguarding your personal assets in the event of legal issues or debts. Additionally, it offers tax reduction advantages through pass-through taxation, potentially placing you in a lower tax bracket and saving you money.

Moreover, having an LLC lends credibility to your business, with the ability to easily obtain licenses and permits, demonstrating to customers and suppliers that you operate a legitimate and trustworthy business.

However, while an LLC is not always required for dropshipping, it is highly recommended due to the significant advantages it provides.

By establishing a clear dropshipping business structure and identity, an LLC simplifies decision-making processes and sets a strong foundation for future growth and expansion.

![The Top 21 3PL Companies Compared [2024 List & Guide]](https://images.weserv.nl/?url=https://prod-dropshipping-s3.s3.fr-par.scw.cloud/2024/03/Frame-3922469.jpg&w=420&q=90&output=webp)