A Step-by-Step Guide to Forming an LLC for Dropshipping

Countless factors contribute to the success of your dropshipping business, from the type of your business, like LLC for dropshipping, the name of the company to the type of product you offer.

One of the most foundational considerations is the type of legal structure you choose for your business. Legal structure can affect everything from how you file your taxes to how you manage the business day-to-day.

While there’s no one-size-fits-all solutions, most dropshipping companies benefit from choosing the Limited Liability Company, or LLC model.

Before making this determination, it can be helpful to know a little bit more about what an LLC is, why it’s advantageous, and how LLCs are formed. Here’s a complete guide to forming an LLC for dropshipping.

Table of Contents

Forming an LLC for Dropshipping: The Basics

First and foremost, what defines the LLC? And what sets it apart from other legal structures?

The important thing to know is that, when you start generating self-employed income, you are automatically classified as a Sole Proprietor in the eyes of the government.

Sole Proprietorships don’t recognize any distinction between the person and the business; in the eyes of the government, you essentially are your business.

There’s nothing wrong with this model, and in fact, it’s how most dropshippers get their start.

The Sole Proprietorship structure does have some limitations, however. For example, it’s challenging for a Sole Proprietor to recruit employees or administer payroll.

As such, many dropshippers ultimately opt into the LLC format.

So, when you register your business as an LLC, you actually create a new business entity, making it possible to maintain a separation between personal assets and business assets. Similarly, the LLC lets you keep personal liabilities distinct from business ones, and vice versa.

What are the Benefits of the LLC?

There are a number of reasons why the LLC structure is advantageous for dropshippers. Some of the main advantages of forming an LLC for dropshipping are as follows.

✅ Personal Liability Protections

The fact that LLCs create a separation between business assets/liabilities and personal assets/liabilities is incredibly important. It’s important because it means your personal money is shielded from litigation and from creditors. So, even if your dropshipping company gets sued, your family’s personal savings or bank accounts are totally secure.

This allows you to invest in your dropshipping company with greater confidence and peace of mind, knowing that there’s a wall in place between business risk exposure and personal risk exposure.

Limited liability protection is a huge deal for business owners, and one of the primary reasons to choose the LLC model. It’s an especially important concept for dropshippers, who may be worried about the fallout of a faulty product.

💡 Tip: Read about LLC vs LLP: What’s The Big Difference?

✅ Tax Benefits

Dropshipping companies also gravitate toward the LLC format because of the tax flexibility it offers. Having multiple tax options is a bit deal for individual owners looking to promote the best tax strategy.

When you start an LLC, your company will automatically report business income as a pass-through entity. This means you declare profits on your tax return, and pay your normal rate.

You can avoid the “double taxation” that Corporations typically owe. With that said, you also have the option of being taxed at a corporate tax rate, should you ever decide that this would be more advantageous.

👉 Learn about Dropshipping Taxes and Payments – Must-Know Facts.

✅ Administrative Flexibility

Not only does an LLC provide wiggle room for how your company pays taxes. It also offers wiggle room concerning how you manage the business day-to-day.

When you register your LLC, you’ll have the option of drafting an Operating Agreement. (More on that later.) This document allows you to determine how you’ll share duties and allocate profits between you and your partners. You may even decide to outsource daily management to third-party management services.

✅ Ease of Setup

Dropshippers also love the LLC format because, compared with other types of business structures, it’s fairly easy to establish.

We’ll get into the specifics later. For now, just know that getting an LLC approved tends to take three to four weeks, sometimes less. The paperwork requirements are minimal, and the startup cost for an LLC can be under $100 total.

There are minimal annual reporting requirements, but again, the administrative burdens are much lighter than what you’d experience with incorporation.

✅ Increased Credibility

Finally, the mere fact that your LLC must go through some legal scrutiny helps to affirm your legitimacy. Simply put, LLCs are perceived as real businesses, not as side hustles or hobbies.

This can be a big help when it comes to earning the trust of your customers, to say nothing of potential investors.

It also means you’ll have an easier time setting up banking accounts in your business’ name. And, having an LLC makes it easier to secure business loans, as well.

How to Set Up an LLC for Dropshipping Businesses

Clearly, there are countless reasons to consider the LLC for dropshipping. The question is, exactly how do you register your company as an LLC?

First and foremost, keep in mind that LLC requirements vary from one state to the next. So, tips to start an LLC in California might be a bit different than tips to start one in Delaware, Florida, or Wyoming.

With that said, the typical trajectory for LLC formation usually goes something like this.

1) Choose the right name for your business.

Any time you choose a name for your company, there are big implications for marketing, branding, and business identity.

For LLCs, the stakes are even higher. That’s because there are legal implications. While the guidelines can vary by state, there are two important rules that apply to LLCs more or less across the board:

- Typically, you need to include either LLC or Limited Liability Company somewhere in your name. Basically, you’re required to let consumers know what kind of business they’re dealing with. But don’t worry: You can also register dba (“doing business as”) names, allowing you to continue doing business under whatever brand name you want. You just need an official LLC name for the government.

- You also have to make sure your name isn’t already in use by another LLC in your state. Most states offer searchable databases, making it possible to confirm whether the business name you’re after is still up for grabs.

The bottom line: Before you do anything else to register your LLC for dropshipping, you’ve got to land on the right business name.

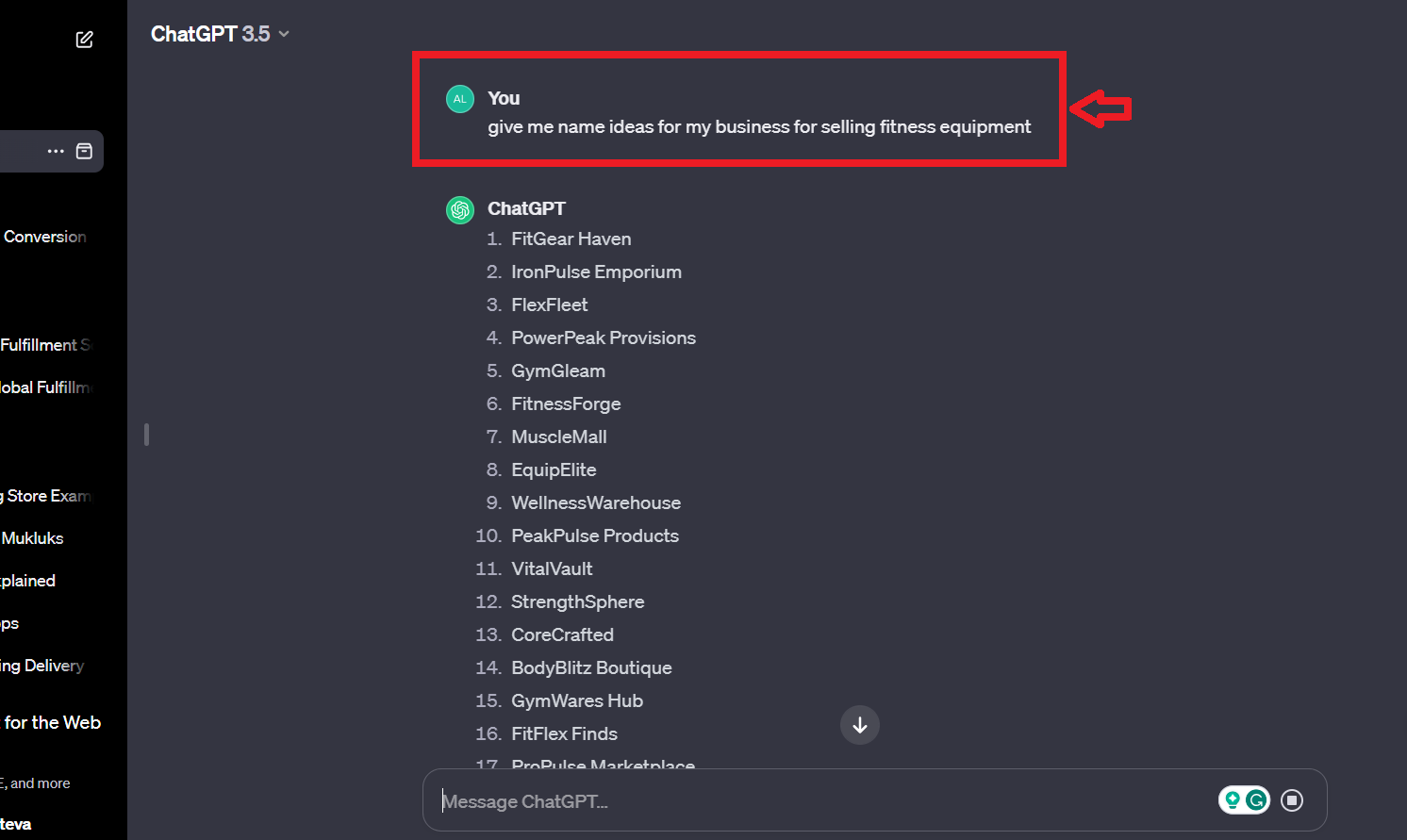

For example, you can use ChatGPT to get ideas for your dropshipping business name. Hence, you just need to use the right prompts to get the one that best describes your business. 👇

2) Select someone to serve as your Registered Agent.

Every LLC is required to have someone serve as their Registered Agent. A Registered Agent can be either an organization or an individual. They are tasked with receiving any legal correspondence sent to your dropshipping business.

In some states, it’s legal to serve as your own Registered Agent. It’s more common for states to require third-party providers. Fortunately, third-party Agents are usually very affordable. In most states, you can enlist a Registered Agent for between $50 and $300 annually.

When selecting a Registered Agent, it’s most important to choose someone who has a local mailing address (that is, an address in your state). A P.O. Box usually won’t suffice.

At first blush, it might seem like the requirement for a Registered Agent is onerous. Actually, it can be a huge benefit to LLC owners. For one thing, you have someone whose job is to keep your legal and tax correspondence organized, which is one less administrative task for you to handle.

And two, if someone ever serves your company with a lawsuit, you don’t have to worry about the papers being served to you when you’re with a customer. Your Registered Agent can handle it discreetly.

👉 Read about Dropshipping Agent: How To Find The Best Dropshipping Agents?

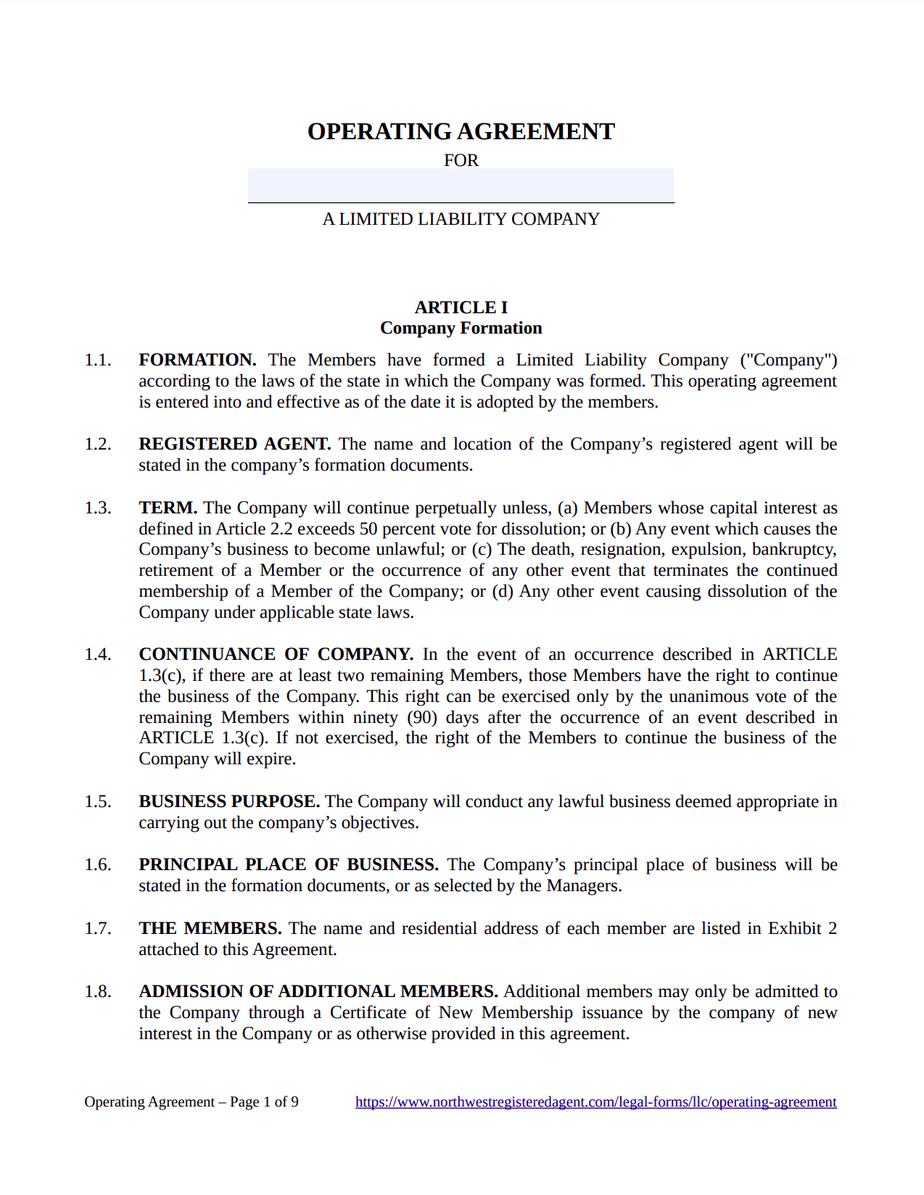

3) Prepare an Operating Agreement.

Next, spend some time developing an Operating Agreement for your LLC.

This isn’t actually a legal requirement, but it can be incredibly advantageous. Your Operating Agreement is a kind of constitution, outlining how your LLC is run from day to day.

As such, it provides a lot of guidance for how you run the business and ensures that you and your partners are always on the same page about your allocation of duties. And, if you ever do have a dispute with your business partners, an Operating Agreement can often provide clarity, ensuring a swift resolution.

Your Operating Agreement may cover a number of different topics, but some of the fundamentals include:

- How you and your partners share managerial duties.

- How you and your partners split profits and ownership percentages.

- How you will incorporate new partners into your business.

- How you will deal with the exit of one of your partners.

Before you move forward with registering an LLC for dropshipping, an Operating Agreement can be incredibly helpful.

4) File your Articles of Organisation

As you can probably imagine, establishing a whole new legal entity requires you to file some paperwork. In most states, the document required is called the Articles of Organization.

You’ll need to complete your Articles of Organization, and then file it with your Secretary of State. This is what officially creates your LLC. Here are a few common questions about filing your Articles of Organization:

- What kind of information do I need to provide? The requirements can vary by state, but usually, you’ll need to provide details about your business name; the scope and mission of your business; and contact information for your Registered Agent.

- How long does it take for the state to approve my LLC? Once you file your Articles of Organization, the approval process usually takes three or four weeks. (Of course, this is just a ballpark estimate, and the exact timeline can vary from state to state.) You may have the option of paying extra for an expedited approval time.

- How much does it cost to register your LLC for dropshipping? The cost of registering an LLC can change from state to state, and you can expect it to be anywhere from $15 to $300. This is in addition to Registered Agent fees, which can run from $50 to $300 annually.

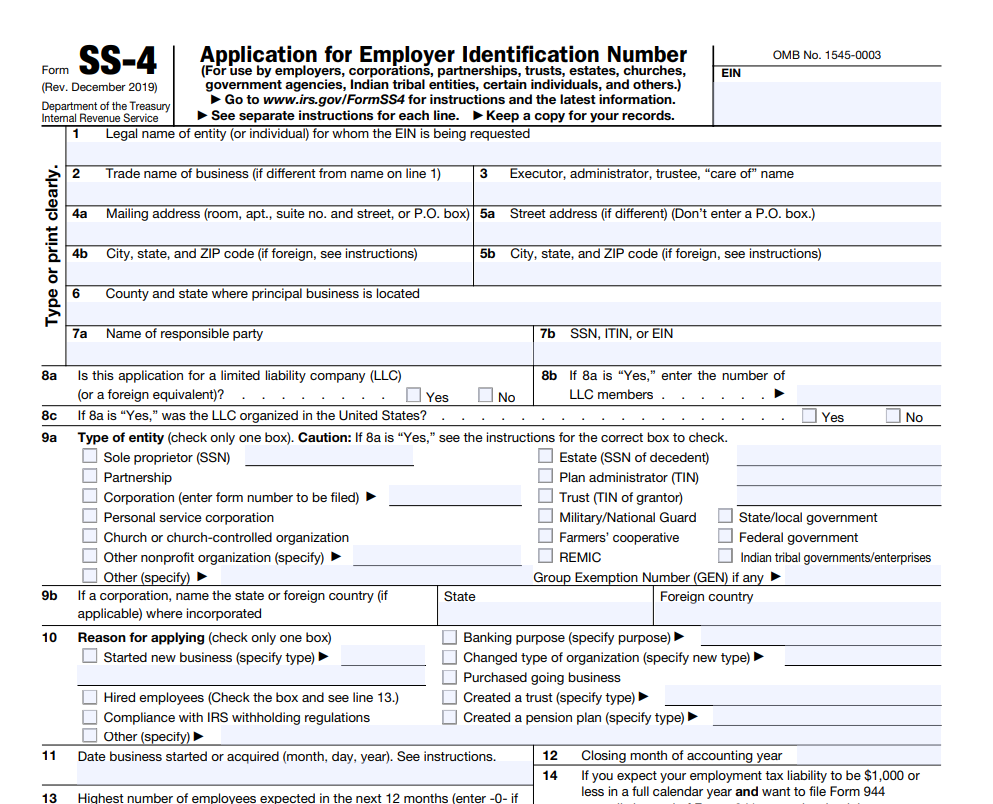

5) Request your Employer Identification Number

You don’t need an EIN right away, but you’ll need it before you can file your taxes or administer payroll.

Fortunately, getting an EIN is pretty easy, and it won’t cost you anything. You can apply for one from the IRS website, and it’s free for any US resident.

6) Set up a business bank account

One of the most important considerations for your dropshipping LLC is to keep your personal and business assets separate. The rule of thumb is:

- Never use personal assets to pay off business expenses; and

- Never use business assets to pay for personal expenses.

The best way to ensure you’re compliant with this rule is to set up a business bank account, one that’s not connected in any way to personal savings or checking accounts.

Naturally, you’ll want to shop around a little to find the bank with the best rates and the most convenient online banking policies.

7) Keep up with annual requirements

To maintain your LLC status, you’ll need to keep up with a few annual requirements. Once again, these requirements will vary depending on the state you’re in.

- Pay your LLC taxes. Thankfully, this only applies if you’re in California, the lone state to have LLC-specific taxes. The flat rate for California’s LLC tax is $800.

- File your annual report. The reporting requirements for an LLC are far less onerous than those for a Corporation. Usually, it just entails a quick confirmation of your LLC’s name, contact information, and Registered Agent.

- Report any changes to your Registered Agent. Finally, you’ll need to let the state know any time you change your Registered Agent, or any time your Registered Agent changes their contact information.

- Keep your business licensing requirements up to date. The business licenses you need will depend on your municipality as well as your industry.

👉 Discover the difference between Seller’s Permit vs. Business License: What Do You Need to Start Selling Online?

Establish a Strong Foundation for Your Dropshipping Business

To establish the long-term success of your dropshipping business, it’s vital to choose the right legal structure. More often than not, that means opting into an LLC. In summary, you’ll need to:

- Choose the right name for your business.

- Select someone to serve as your Registered Agent.

- Draft an Operating Agreement.

- File your Articles of Organization and pay the filing fee.

- Claim your EIN.

- Set up a business bank account.

- Keep up with annual reporting requirements.

With the steps presented here, you can get your LLC up and running as quickly and conveniently as possible, and begin taking advantage of the many LLC benefits, including personal asset protection.

![The Top 21 3PL Companies Compared [2024 List & Guide]](https://images.weserv.nl/?url=https://prod-dropshipping-s3.s3.fr-par.scw.cloud/2024/03/Frame-3922469.jpg&w=420&q=90&output=webp)